AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

December 2025

Categories

All

|

Back to Blog

Peter Oakes, Enforcement Expert & Lawyer Peter Oakes, Enforcement Expert & Lawyer Here's an enforcement action which will serve as a useful typology for fitness and probity, not to mention culture and behavior, as Ireland heads towards a Senior Executive Accountability Regime by Peter Oakes Peter is was appointed the first Director of Enforcement and Ant-Money Laundering at the newly reconstituted Central Bank of Ireland in 2010, where he led and developed the creation and staffing of the new Enforcement and Anti-Money Laundering Directorate with responsibility for delivering administrative sanction procedure enforcement actions, unauthorised providers actions, fitness and probity supervisory and enforcement actions and development of new regulatory laws. Peter has worked on a number of regulatory enforcement matters since leaving the Central Bank and is available to advise and represent on such matters. Read more here Bullet Point Summary

Continue reading this blog at CompliReg

0 Comments

Read More

Back to Blog

Why would one start an article about fintech referencing Covid-19? The fact is that the virus is acting as both a headwind and tailwind for fintech companies operating from Ireland and internationally. The impact of the virus over the last month and a half on fintech has shone a spotlight on many aspects of the ecosystem that might not have otherwise come to our attention. In the current climate Ireland must also be mindful of any potential slippage of its position as a global fintech player garnered from recent years of excellent work. Let’s start with an overview of fintech. The word fintech came to prominence after the last financial crisis, particularly noticeable from 2012 onwards. Yet there were many examples of ‘financial technology’, shortened to “fintech”, existing well before the start of the last financial crisis. A number of these fintech businesses date back to the latter part of the 1980’s. Examples include the internet and phone retail bank First Direct (a division of HSBC) which kicked off in 1989 and today regularly achieves high satisfaction rates in financial surveys. Ireland too served as HQ to a pioneer challenger bank, First-e, which despite great promise was a casualty of the dot.com boom. What does the Irish fintech scene look like? The consensus is that Ireland is home to somewhere between 220- 250 indigenous fintech companies and that together with international fintech companies in Ireland, the number is probably around 400. It is difficult to give an exact figure if only because the word “fintech” is a broad-church.

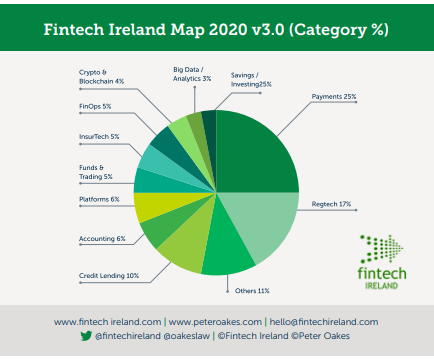

The word captures, (a) the new nonbank disruptors which focus on discrete parts of the banking value chain, e.g. payments, wealth management, treasury services and credit and lending; (b) the new breed of digital only (non-branch) challenger banks entering both retail and business banking; and (c) the incumbent banks (sometimes referred to as legacy banks) embarking - with various degrees of success – on digital transformation journeys. The recent release in April of the 2020 edition of the Fintech Ireland Map4 identified 230 indigenous / Irish controlled fintech companies. This was an increase of 30% from the previous year. The Map is supported by both research and a survey. The criteria to meet to join the Map is challenging. Entrants must be fintech companies with a proprietary product or service. Broadly speaking the fintech companies operate across 12 categories, being Credit & Lending; Platforms; Funds & Trading; Crypto & Blockchain; FinOps (Financial Operations); InsurTech (Insurance Technology); Accounting; Payments; RegTech (Regulatory Technology); Savings / Investing; Big Data / Analytics; and Others. The number of firms in each category is shown in the diagram below. IF YOU LIKE WHAT YOU HAVE READ SO FAR, CONTINUE READING AT THE SOURCE (FREE - NO ADS) AT COMPLIREG

Back to Blog

WATCH VIDEO HERE

Recorded for ACAMS 24+ Financial Crime Marathon (2 & 3 June 2020). This video is a discussion between Shilpa Arora, AML Director - Europe, Middle-East and Africa at ACAMS and Peter Oakes (Fintech Ireland, Fintech UK & CompliReg) on The Latest and Greatest in the World of Fintech. Sound starts at 25 seconds into video following title slides. Big thanks to ACAMS for the invitation to join such an excellent event. WATCH VIDEO HERE |

© Peter Oakes (all rights reserved)

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.