AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

December 2025

Categories

All

|

Back to Blog

Peter Oakes, former director of AML enforcement at the Central Bank of Ireland, told moneylaundering.com that regulators expect compliance personnel to fully apprise themselves of the purpose, capabilities and limitations of any regtech their institutions acquire, and do not wait around for an internal audit to identify any problems. “Unthinking” reliance on new technologies landed roughly half of the more than 250 financial services companies found to have breached anti-money laundering rules in the EU this year in hot water with their national supervisors, a senior regulator has warned.

Carolin Gardner, head of AML at the European Banking Authority in Paris, told ACAMS moneylaundering.com that concerns now abound that financial institutions frequently fail to deploy the latest transaction-monitoring software and other innovative tools effectively, creating gaps in their compliance programs that can persist “for a significant period of time.” “One of the challenges, based on what supervisors are telling us, is that technology is being employed before it’s properly tested, and that [it] then has the potential to actually weaken institutions’ systems and controls,” said Gardner. In January 2022, as part of a broader effort to strengthen and harmonize AML oversight across the European Union, the European Banking Authority, or EBA, launched EuReCA, a bloc-wide database where national regulators log any “material weakness es” found at financial institutions, and the remedial measures or other steps they took in response to them. Regulators in the bloc’s 27 nations have uploaded a combined 771 AML violations at 256 banks, money services businesses and other financial institutions on the database so far this year. At around half of those companies, improper use of new regulatory-compliance technology, also known as regtech, laid at the heart of the breaches. Artificial intelligence-driven software, advanced data-analytics tools and other regtech products hold the promise of radically improving customer-identification and -verification processes, bolstering detection of potentially illicit transactions and helping compliance officers untangle complex corporate structures. But national supervisors have observed a substantial uptick of cases in which banks and fintechs neglected to check whether their newly acquired, compliance-related technologies delivered as promised, and failed to ensure that senior managers consistently monitored their use. “We are in favor of technology, we don’t think the fight against financial crime has a future without it and we have seen excellent examples where it works fantastically,” said Gardner. “Our concern at the moment is that not everyone is using technology in the right way.” EU supervisors have reported 377 enforcement actions or other supervisory responses to EuReCA since January. Details of many of the associated violations show that regtech-related shortcomings appeared in all areas of AML compliance. “It’s difficult to pinpoint exactly what’s going wrong where, because it’s really a little bit of everything,” said Gardner. “This is clearly an area where we feel we need to intervene, and we need to intervene fast.” Regtech-related problems have also become a regular topic of discussion at the EU’s supervisory “colleges,” forums where national regulators share information (https://www.moneylaundering.com/news/eu-aml-supervisory-colleges-grow-in number-effectiveness-eba/) on the AML programs of financial institutions that operate across borders. Peter Oakes, former director of AML enforcement at the Central Bank of Ireland, told moneylaundering.com that regulators expect compliance personnel to fully apprise themselves of the purpose, capabilities and limitations of any regtech their institutions acquire, and do not wait around for an internal audit to identify any problems. “They normally already have a framework for product governance elsewhere, but firms need to extend that to any regtech offerings they bring on board,” said Oakes, now a consultant in Dublin. “They also need to identify it [new regtech] as a risk, so that there’s a discussion around monitoring and regular testing.” The EBA plans to conduct additional research on the problematic trend ahead of publishing an “opinion” on emerging money laundering- and terrorist financing-related risks next year. Contact Koos Couvée at [email protected]

0 Comments

Read More

Back to Blog

Global Government Fintech Lab 2024 panel session one: Siobhan Benita (moderator), Karen Cullen, Dominik Freudenthaler, Peter Oakes and Robert Rampre | Credit: Deirdre Brennan for Global Government Fintech. The panel for the ‘Governments and ntech: on the right path?’ session comprised: Karen Cullen, who heads a ntech steering group alongside her principal role as head of international nancial services in Ireland’s Department of Finance; Dominik Freudenthaler, ntech expert in Austria’s Federal Ministry of Finance; Peter Oakes, the founder of independent network Fintech Ireland; and Robert Rampre, undersecretary in the insurance and capital market division at Slovenia’s Ministry of Finance.

Regtech Oakes began by referring to Freudenthaler’s examples, pointing out that the rollout of digital government services would typically involve multiple elements of back Peter Oakes (second from right in photo above) at Global Government Fintech Lab 2024 end technology powered by private-sector innovation. “I ask: would any of those [innovations] actually have been achievable if there hadn’t been regulatory technology [RegTech] applications that were doing the verification of customers who wanted to open bank accounts? Without that, the innovation in government to improve public services may not have happened at the rate that it did,” Oakes (who also appeared at last year’s Lab: on a panel discussing data) said. Global fintech investment decline Oakes concluded by highlighting the IMF working paper’s conclusion on the relationship between fintech and economic growth. The paper, based on analysis of 198 countries’ data between 2012 and 2020, stated that: ‘Looking forward… fast-growing fintech is likely to have a greater effect on economic growth. In this context, maintaining financial stability is sine qua non for sustainable growth and that requires strong regulatory institutions, better use of technology in regulation, extensive cross-border coordination and appropriately calibrated prudential regulations for a level playing eld and effective monitoring and supervision of traditional and emerging financial institutions.‘ Sandbox dilemma Oakes stated that while sandboxes may often benefit nascent innovators, they are also help established companies that “want to keep an eye on younger players that might ‘disrupt’ them out of business.” “It depends on what the sandbox is going to do, how it’s going to be measured and how transparent it will be with its findings,” Oakes continued. “I do think that, overall, if there’s a budget and resources, it should be created. But I think those who run sandboxes need to prepare [their expectations] that they may not be inundated from day one with applications.” Read more - Website: here and PDF: here

Back to Blog

Access White Paper Here

In the not too distant past, senior management within financial institutions may have regarded failure to comply with anti-money laundering (AML) requirements as low impact. The 2007/8 financial crisis as well as subsequent scandals in financial services have shown the error of this approach. When it comes to AML, the current COVID-19 crisis may pose an evolving and unpredictable threat. To avoid a repetition of the previous mistakes, financial institutions must now put into practice lessons learned from the past; the most urgent one in my book, is that institutions should be adopting a culture of compliance with a ‘live and breathe’ approach to regulatory requirements. In a recent article in the Economist, Jürgen Stock, secretary-general of Interpol, was quoted as saying that COVID-19 may create the ideal conditions for the spread of serious, organised crime. Moreover, Mr. Stock believes that the immanent global economic depression will offer these criminals a chance to extend their reach deep into the legitimate economy. As COVID-19 motivates criminals to evolve their operations, those responsible for stanching the flow of ill-gotten gains into the legitimate economy must stay one step ahead; and this includes financial institutions with their AML obligations. I recently published a white paper on the lessons to be learned from the last financial crisis. For those interested in how a culture of compliance can address complex misconduct relating to AML, this paper is well worth a read. Through reviewing a number of high-profile case studies, I come to the conclusion that at the heart of many AML failures is an institutional culture that treats AML training and procedures as merely means to meet regulatory requirements. The case studies show that these banks failed to ‘live and breathe’ regulatory requirements and that the institutional culture prioritised compliance as merely a tick the box exercise, thereby failing to communicate to employees the priority of compliance and the flexibility of decision making and behaviour that may be necessary to fulfil their AML requirements. Culture is a complex issue. For those interested in how RegTech can enable an examination of institutional culture, through diagnostic tools, the white paper is a must read. In the paper, I explore how The Mizen Group, a RegTech firm based in New York, has developed a suite of tools to help boards and their compliance officers assess the extent to which their institution demonstrates the characteristics of an organisation with a strong compliance culture. The financial crime threats posed by COVID-19 mean that now is the time to commit to a culture of compliance from the ground up. Launderers and criminals are capitalising on the chaos created in the wake of the pandemic and are seeking ways to out-manoeuvre the financial institutions who are generally playing catchup. In response, board of directors and executive management need to be proactive and flexible in their thinking and develop a ‘live and breathe compliance’ mentality. This will only occur in a healthy compliance culture, wherein employees are empowered to internalise the importance of complying for the right reasons. The first step towards the goal of a healthy compliance culture might be employing tools like Mizen’s innovative culture diagnostics to assess their institutions’ cultural strengths and weaknesses. Feel free to contact the RegTech experts at The Mizen Group for further information. Access White Paper Here This blog also appears at https://complireg.com/blogs--insights.html

Back to Blog

Why would one start an article about fintech referencing Covid-19? The fact is that the virus is acting as both a headwind and tailwind for fintech companies operating from Ireland and internationally. The impact of the virus over the last month and a half on fintech has shone a spotlight on many aspects of the ecosystem that might not have otherwise come to our attention. In the current climate Ireland must also be mindful of any potential slippage of its position as a global fintech player garnered from recent years of excellent work. Let’s start with an overview of fintech. The word fintech came to prominence after the last financial crisis, particularly noticeable from 2012 onwards. Yet there were many examples of ‘financial technology’, shortened to “fintech”, existing well before the start of the last financial crisis. A number of these fintech businesses date back to the latter part of the 1980’s. Examples include the internet and phone retail bank First Direct (a division of HSBC) which kicked off in 1989 and today regularly achieves high satisfaction rates in financial surveys. Ireland too served as HQ to a pioneer challenger bank, First-e, which despite great promise was a casualty of the dot.com boom. What does the Irish fintech scene look like? The consensus is that Ireland is home to somewhere between 220- 250 indigenous fintech companies and that together with international fintech companies in Ireland, the number is probably around 400. It is difficult to give an exact figure if only because the word “fintech” is a broad-church.

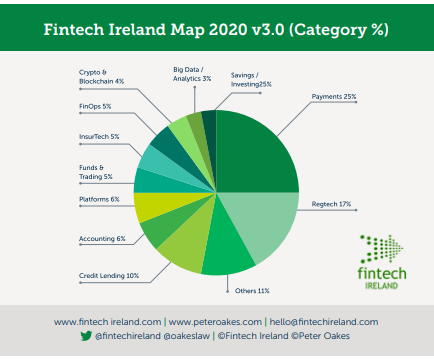

The word captures, (a) the new nonbank disruptors which focus on discrete parts of the banking value chain, e.g. payments, wealth management, treasury services and credit and lending; (b) the new breed of digital only (non-branch) challenger banks entering both retail and business banking; and (c) the incumbent banks (sometimes referred to as legacy banks) embarking - with various degrees of success – on digital transformation journeys. The recent release in April of the 2020 edition of the Fintech Ireland Map4 identified 230 indigenous / Irish controlled fintech companies. This was an increase of 30% from the previous year. The Map is supported by both research and a survey. The criteria to meet to join the Map is challenging. Entrants must be fintech companies with a proprietary product or service. Broadly speaking the fintech companies operate across 12 categories, being Credit & Lending; Platforms; Funds & Trading; Crypto & Blockchain; FinOps (Financial Operations); InsurTech (Insurance Technology); Accounting; Payments; RegTech (Regulatory Technology); Savings / Investing; Big Data / Analytics; and Others. The number of firms in each category is shown in the diagram below. IF YOU LIKE WHAT YOU HAVE READ SO FAR, CONTINUE READING AT THE SOURCE (FREE - NO ADS) AT COMPLIREG

Back to Blog

Australian Bank giant Westpac is expecting to fork out more than $1 billion as a result of its money laundering scandal and admitting to 23 million anti-money laundering breaches.

It's not just story about culture, conduct risk and financial crime risks. Far more importantly, it is a story of shame, leadership failure and financial pain for Westpac and relief for another Aussie bank. The fine would be the biggest corporate fine in Australian history. Westpac has revealed it expects the ongoing AUSTRAC investigation will cost it $1.03 billion. Such a fine will represent about 15% of the bank's 2019 profit. Shame: In November last year AUSTRAC, the entity responsible for preventing financial crimes, said the bank had violated anti-money laundering and counter-terrorism laws more than 23 million times (which the bank admits), allowing money tied to child exploitation in south-east Asia to flow freely. For example, Westpac's system was used by paedophiles to send money to the Philippines to pay for child abuse material without raising any red flags. Notwithstanding Westpac's admission, the bank is not going down without a fight. In the 57-page defence document filed with the court, Westpac denied AUSTRAC'S accusation that it failed to identify activity indicative of child exploitation risks. Leadership Failure: The scandal brought down Westpac's leadership, forcing the resignation of chief executive Brian Hartzer and the early retirement of chairman Lindsay Maxsted. Financial Pain: Last year Australian financial press reported that a penalty or settlement of $2 billion or $3 billion would see its CET1 ratio falling below 10.5% meaning the bank would be forced into another equity raising. And the trouble doesn't stop there for Westpac as the corporate regulator, ASIC, is probing into Westpac's previous $2.5 billion equity raise. Relief: Commonwealth Bank will be delighted to pass the mantle of the indignity of Australia's current money laundering record fine of $700 million to Westpac (Commonwealth Bank was fined for systemically failing to report around 54,000 suspicious transactions made through its "intelligent deposit machines"). If you want more on the story from the media, there are updates on an almost weekly basis - soon I guess daily basis. Just use this link to keep track of the story: "Westpac Austrac money laundering fine". And add case to your case studies and typologies in your AML / CTF training for everything from CDD, transaction monitoring, risk assessment, culture, condusct risk and (lack of) crisis management. Peter Oakes, Founder, CompliReg Peter Oakes is an experience anti-financial crime, fintech and board director professional. He served as Ireland's first Director of Enforcement and Financial Crime Supervision at the Central Bank of Ireland (2010-2013) in the aftermath of the financial crisis, leading the investigation and enforcement efforts into the Irish banking industry. Peter is a regular contributor to, and moderator and panel member at, ACAMS events. |

© Peter Oakes (all rights reserved)

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.