AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

December 2025

Categories

All

|

Back to Blog

“With crypto firms able to passport their services across the EEA, there is the possibility of thousands of fintechs doing business here while being authorised elsewhere,” Non-executive director Peter Oakes, founder of Fintech Ireland and former enforcement director at the Central Bank of Ireland comments within an insightful piece by Charlie Taylor of the Business Post. In terms of optics, Coinbase’s decision to relocate doesn’t look great for Ireland Inc. But in truth, it ultimately might not matter. Peter Oakes, a former Central Bank enforcement director and founder of Fintech Ireland, an industry group, said that while many exchanges may get authorised elsewhere, there is still the potential for Ireland to become a hub for compliance and risk management. “With crypto firms able to passport their services across the EEA, there is the possibility of thousands of fintechs doing business here while being authorised elsewhere,” he said, noting that Coinbase was still keeping a big presence locally. Even so, this is a debate that is unlikely to end any time soon. Source: https://www.businesspost.ie/tech/charlie-taylor-is-the-central-bank-pushing-fintechs-away-from-ireland/ "Is certain negative narrative from 'unnamed insiders' about the Central Bank of Ireland informed, wise and indeed accurate?" Is certain negative narrative from 'unnamed insiders' about the Central Bank of Ireland informed, wise and indeed accurate?

0 Comments

Read More

Back to Blog

Sharon Donnery: deputy governor, Central Bank of Ireland said: ‘Contrary to some beliefs, central banks and regulators welcome innovation.’ According to Fintech Ireland, a body set up to promote innovation, which is led by former central banker Peter Oakes and co-organised the conference, there are 80 authorised fintechs in Ireland. Many Irish fintechs are still failing to fulfil their “basic statutory obligations” when it comes to protecting consumers’ money, the deputy governor of the Central Bank of Ireland (CBI) has warned. Sharon Donnery, the person in charge of financial regulation at the CBI, issued a sharp rebuke to some rms in the sector at the Fintech Ireland Summit in Dublin on Thursday. Some rms, she said, have still not understood the regulatory principles of good governance, risk management and consumer protection, with others failing to “sufficiently” deliver them. Donnery did, however, welcome interest from fintechs in the CBI’s so-called innovation sandbox – a hub where rms can test out new products under regulatory supervision – and disclosed that nearly 40 rms had applied. “Contrary to some beliefs, central banks and regulators welcome innovation,” Donnery said at the conference. “While we don’t embrace it indiscriminately, our mandate is to deliver in the public interest.” Fintechs have sometimes questioned the CBI’s “defensive” approach to firms seeking authorisation.

According to Fintech Ireland, a body set up to promote innovation, which is led by former central banker Peter Oakes and co-organised the conference, there are [80] authorised fintechs in Ireland. Miriam Dunne, the regulator’s head of innovation and stakeholder engagement, admitted last year the sector’s development posed a “challenge for our mindset” and noted that the regulator is “committed more now to fostering innovation”. Donnery, though, struck a more hawkish tone towards fintech regulation on Thursday, noting the CBI’s expectations for the sector “are not new”. “Unfortunately it does have to be said that our supervisory experience continues to point to instances of rms failing to provide the basic statutory obligations around protecting people’s money,” she said. In an age of rapid technological advancement, Donnery also said the “basics” – good governance, risk management and consumer protection – “remain true”. “While these principles are general, our supervisory experience tells us they’re not always understood. “Or, if understood, they’re not necessarily sufficiently delivered,” she said. Donnery said that while it was understandable some ntechs would focus on fast expansion, “growing the business without also properly growing its control frameworks is not really a recipe for sustainable success”. “And indeed it is not acceptable for regulated providers of nancial services,” she added. Donnery said both the CBI and regulated rms are responsible for looking after people’s money and nancial wellbeing. “For those that are trusted with that responsibility, there are some basic expectations – in particular that you’re well-run, have good governance and risk management capabilities commensurate with,” she said. Despite that, Donnery said the CBI was “delighted” at the breadth of companies that applied for its innovation sandbox, for which applications closed in recent weeks. “Almost 40 [ rms] in total” applied for the programme, she said, including companies from Ireland, the EU and the UK. Applicants represented a “really wide variety of rms – from start-ups to established fintechs, to incumbent financial services providers,” she said, adding that the regulator would announce the selected participants in the coming weeks.

Back to Blog

BF: The success of Ireland’s fintech sector has been underlined by large recent investments from major players. For example, Mastercard set out to create 1,500 jobs in Ireland and build its European Technology Hub in Dublin. Similarly, Stripe set out to create 1,000 jobs to set up a European base to launch its global products. What do you think are the main factors for Ireland being such an attractive market for fintech companies? How does it differentiate from other global markets? Peter Oakes: The starting point really is thinking back to how Ireland got involved in technology. That is because we had a large number of US companies that set up here. Microsoft has been here for close to 40 years. Those information technology firms that set up here had a whole core of people who at one point or another left those businesses and set up their own entrperneurial technology firms in Ireland. There’s the fact that we had the talent in Ireland, there’s the fact that we’re growing the talent in Ireland, we have high levels of education. Just under 60% of people under 40 have a 3rd level education, with 30,000 holding a PhD. At that tertiary qualification level, Ireland really excels. Obviously, there’s always been the tax element, Ireland being attractive because it was considered to have a competitive or lower tax rate. That’s moving up from its historic 12.5%, which used to be 10%, to 15% in accordance with all the OECD brokered tax rate reforms. Regardless it is important to note that Ireland is not losing its market strength because Ireland isn’t built on the back of a tax rate; it’s just one part of the story. The continued growth and investment in Ireland are happening regardless of the headline rate of tax going up. That may surprise some people. Also, the fact that we have a common law legal system is a real positive. People and businesses from America, Asia, Australia and the UK trust the common law system. They trust it in the sense that they know that if they end up having to go to court, they might not win every case but they believe they will be treated fairly through the process, which actually is really important to major corporations. They will get a fair bite of the cherry so to speak. Ireland’s success is driven by one of our largest trading partners, the United Kingdom, with which we have a Common Travel Area predating Brexit. Although Brexit has been a harsh thing for many countries to accommodate, for Ireland it hasn’t meant any problems in the sense that someone from the UK can travel into Ireland freely, and Ireland to the UK freely. I’m a prime example of that: I travel to the UK on a fortnightly basis to work with my UK law firm. I don’t go pass border checkpoints. I walk straight through because I came through the Common Travel Area. The importance of that ability of moving human capital freely can’t be overstated. Ireland also benefits from having a pre-clearance arrangement with our largest export partner, the United States, meaning that passengers arriving in the US are treated as domestic arrivals, allowing them to avoid immigration queues upon arrival and pick up their bags and go. In addition, this arrangement allows US bound passengers to undertake all US immigration, customs and agriculture inspections in Ireland prior to departure. Next thing to note is our ease of doing business. We are on the cusp of being in the top 10% of countries in the World Bank rankings for ‘Ease of Doing Business.’ That recognition of the ease of setting up in Ireland makes it a lot more straight-forward for firms to establish here. We have a transparent tax system too. We have one of the most extensive double taxation treaties of any country in the world, which, including the United States, amounts to 76 countries. That’s very helpful. Another big plus is that Ireland is an English-first business language country. These ingredients all together represent a key cornerstone of the Irish ‘can-do’ business foundation. Obviously, then, there is the local development of technology: having the right business culture environment, having the right tax system, having the right people. These have meant that we’ve really grown in terms of innovation. We might not be as strong in fintech as some other jurisdictions which commenced their journey ahead of us, but we certainly aren’t doing badly at all in the relatively short time since the government focused on supporting fintech. In Ireland, arising from that history I gave you has led to us having around about 270+ indigenous fintechs. We have more than 120 international fintechs set up in Ireland. At Fintech Ireland, we run a survey of fintechs, and to get onto its famous maps, the fintechs have to complete the survey; it’s part of our validation process for a company to be mapped. One of the questions we ask the fintechs is to tell us the top five jurisdictions that they plan to expand to from Ireland. Indigenous Irish companies, more often than not, depending on where we are in the timeline, have said it’s the US. If it’s not the US in one survey, it might be the UK, but then it flips back to the US. The survey has also revealed examples of fintechs saying, “we’ve set up in Ireland to take advantage of European intellectual property laws and protection prior to expanding our offering across Europe, while also using the home base of Ireland and operations in Europe to underpin expansion in the US as well as Ireland.” It is remarkable to think that a US fintech would see Ireland as a gateway to growing their business ‘back at home.’ BF: Fintech Ireland was established in 2014 to promote the fintech market, which has since boomed. Can you give our readers an overview of the organization’s ethos and mission to make Ireland a global hub for fintech? Peter Oakes: Fintech Ireland; it’s a lot like the word fintech, it’s a very broad church. We’re just one of many voices out there that are tuned into the same message. That is, if you need to set up operations in the European Union, then why not Ireland? In 2014 when I kicked this off, I was working quite a bit in United Kingdom. I was working with an American bank, Bank of America. The team was setting up the bank’s specialized payments business. Coming out of the financial crisis, things like fintech— a buzzword — began to develop. But fintech has been around for quite some time. The UK had one of the very first fintech banks anywhere in the world, way back in 1995, called First Direct. But when I was in London, the word fintech kept coming up. Also, the cryptocurrency discussion came up after they were born in 2008-2009. Everyone kept talking about the opportunities for UK fintech. I just took a punt and I said I’ll register some domain names and I’ll see what happens. I registered FintechUK.com. I put up a small website, and I was inundated with people saying, what’s it about? What’s it going to do? I realized that just by myself, even if I get two or three other people, it’s going to be too hard to tackle that UK market. So, I wondered, what’s happening in Ireland while I’m working three days a week in the UK? What could I do on the Mondays and Fridays in Ireland in fintech while I am there? I spoke to a couple of guys at the time, and we said why don’t we get this Fintech Ireland underway. Since then, people have swapped in and swapped out driving the initiative, but a core group remains raising awareness, helping with events, helping fintechs set up in Ireland and mentoring them on the journeys overseas. We’re not aiming to be an association as such; we’re not aiming to become a quasi-government body. We simply want to be out there and promoting why Ireland is a great place for fintech. Probably, the fact that we’re not a government agency, the fact that we’re not a subscription-based trade body or an association means that we have a different and independent story to tell. It means people gravitate to us for a different reason. We’re quite lucky that, in order to cover our costs and things that we do, a lot of companies will volunteer their premises, like TransferMate (a B2B payments provider), and accelerators like Dogpatch Labs will give us some space to run events. We’ve had blockchain companies support us too, engendering an opportunity for some very clever people to get together in a room and have diverse and safe conversations on the direction of the industry and support they need. Fintech Ireland is also like a think tank and match-making service. In some of those meeting rooms, people have met, got together and have started their own fintech operations. It hasn’t been specifically because of us. They have met each other at different events, but they keep bumping into each other at these different events, they’ve obviously got the same ethos and culture, they share that with us, and they decided to go on the journey. What I was also doing, because I probably had more time than the other guys involved was giving free mentoring time, which I still do, especially to young fintech companies. The fintechs that Fintech Ireland mentors are more advanced than the ‘two guys/girls with a power point deck’; they’ve actually made a commitment to a business, and they turned to me and asked: “if we continue down this path, what is the likelihood we might trigger regulation.” Being a regulatory expert, I can say they need to start planning for the hoops that they will need to jump through. They’ll also ask me about what sort of supports are available to them and we can signpost them to those supports, whether it’s the NDRC, the National Digital Research Centre, or the accelerators, or we can remind them of the strong support offerings provided by Enterprise Ireland. I think FintechIreland.com is now the number one organic result on Google search for the words “Fintech Ireland” anywhere in the world. That means that international companies easily find us, so I end up having a lot of discussions with firms that I may never physically meet. If these firms need more than what we can offer through the information on the Fintech Ireland website, we can provide say15-20-30 minutes of video time to discuss what their entry strategy into Europe, and particularly Ireland, may look like. I have a number of companies from the US I’m talking to right now. Some of them are looking at moving over in the next 12 months, some are looking to move in much shorter time periods. What we do at Fintech Ireland is provide information. Fintechs can visit the website, they can go to one of the recent events we have held, and they can click and download the slides, and they can sit there at their own leisure, and read through the slides and say, I now have a stronger overview. Recently, one of the American companies said to me that it used our PowerPoint deck as part of the business proposition it provided to its US senior management. I said how did it work out? And he said I can’t tell you just yet, as the jury is still out, but it’s looking positive for an Irish set-up. He said the website was the only jurisdiction website he came across, through a quick and simple search, where he found all the relevant information that he needed to help support the business case. Obviously, the financial numbers have to work; obviously the human resource piece has to work, but getting across the benefits of Ireland to decision-makers who aren’t familiar with Ireland and what was going on here underpinned why Ireland rose to the top of their potential European locations. BF: What’s your business model? How does Fintech Ireland make it, if it’s not government run? How are you a profitable organization? Peter Oakes: It’s not profitable because it doesn’t actually make revenue. So it is not only a non-for-profit, but it is a not-for-revenue initiative. I guess effectively it makes a loss. It doesn’t exist like a corporation; it’s almost like an early model of a decentralized autonomous organization. I cover all the costs myself personally. My own business is involved in advising fintechs and professional services firms on getting authorized across Europe, and predominantly here in Ireland. I’m also on the board of a number of regulated financial technology companies. I’m an advisor to a number of firms and, in particular, to Armstrong Teasdale, a US HQed law firm with operations in London and Dublin where I work as fintech practitioner. I’m lucky that, through the income I earn, I’m able then to dedicate six to eight hours a week to the Fintech Ireland project, and therefore, together with the free support of others, Fintech Ireland project doesn’t need to charge a fee to anyone but we are always happy to talk to sponsors to cover our costs. For that reason, it’s working right for us now. If demand continues to go the way it has, I’m going to need someone just to handle the phone calls and emails. What we could end up doing is becoming a bit like a Fintech Holland. It is a membership network, which will work off a freemium model and separately a premium model. But the one thing we are conscious of is that we want to keep the freemium model working as best as possible because that’s the reason we’ve become so well known. BF: The number of fintech and tech SMEs in Ireland is growing, but these companies are currently hitting fresh challenges such as a hike in energy prices. How would you assess Ireland’s current support systems for its start-ups? What kind of policy changes are required to further strengthen the SME market in Ireland? Peter Oakes: It’s not just the energy prices obviously. It’s a combination of factors that’s hitting not just our jurisdiction, but every other one. We also have increasing inflation. Obviously energy prices are a key cause of inflation, and this is countered by central banks increasing interest rates, so you get into a vicious vertical spiral or, worst case, a recession. Yet by all indications, Ireland looks like it will avoid recession and probably be the leading country in the EU in terms of GDP growth. That is extraordinary for a country with just 5 million people. But we will see some pressure, for example, the impact on securing talent. For a little while, sourcing talent was a bit of a challenge for firms in Ireland as we were at full employment. Now we are seeing a number of technology and fintech companies announce layoffs. We’ve even seen US companies here in Ireland, such as Intel, announce three-month sabbaticals and pay cuts for staff to help reduce the likelihood of job cuts. Those headwinds are caused by global storms and Ireland needs to weather them. Now the view, on the one hand, is that this is a transitional or temporary type of inflation, as some of the central banks have claimed, but that perceived temporary nature seems to have extended a lot further than what people originally thought. Even recently, the chief economist and board member of the ECB, Philip Lane (a former governor of the Central Bank of Ireland) said that, in his view, potential interest inflation is now peaking. On the other side of the world, Philip Lowe, the Governor of the Reserve Bank of Australia is in the limelight following a couple of missteps including announcing that interest rates will remain low for three years, and then rates rose quickly from 0.1% to 3% with no sign of stopping in the near term. Mr Lowe is now dealing with quite a tetchy government and people saying that they bought their houses on the basis of his earlier statement that interest rates weren’t going to go up for sometime. The US interest rate environment is interesting too and it is unclear whether rate rises might come to an end or whether rate hikes will be smaller than past ones. Will that take the heat out of rising energy prices; to some degree, yes. But there’s another thing: the war in the Ukraine and disruption to supply chains is adding costs, and therefore introducing inflation which is countered by increasing interest rates. Ireland is not immune to global affairs, nor the economic, nor climate challenges. It is a small and open economy, meaning that the Irish government doesn’t have many levers to pull in this area. First of all, just like with the Covid measures, and like every other country during Covid, Ireland has introduced a cost-of living program of about €4 billion in one-off measures including energy credits for households, social welfare payment enhancements, and a business energy support scheme. Many Irish business are still benefiting from a Covid introduced low interest tax debt warehousing scheme which allows companies to defer repayment of their tax liabilities at preferential interest rates. The Irish government has created a €90 million seed fund available to start-up firms in Ireland. We also have the the NDRC made up of four geographically diverse hubs. Through the NDRC, these hubs also have the ability to make investments of up to Euro100,000 to firms that meet their criteria. They also offer what’s called SAFE (Simple Agreement for Future Equity) investment contracts pioneered by the US’s own Y Combinator, an investor in many globally successful fintechs. SAFE is considered to be a fairer way for startups to get access to funds. Away from fintech, we have Microfinance Ireland, which makes available low interest loans to SMEs. If you’re familiar with the way the UK does it, Ireland’s model is not a million miles away. We weren’t as aggressive as the UK government in terms of underwriting loans from a selection of banks to SMEs during Covid, which is now causing a few problems for the UK government and the banks trying to figure out if any of those loans were given, unfortunately, in fraudulent circumstances. But in terms of other local support we have an Ireland for Finance Strategy which sets out what the government’s initiatives are for the local and ever-growing international financial services sectors. I guess from the government angle, we have the Ireland for Finance initiative, we have the Euro90 million start-up fund, we have Enterprise Ireland supports looking after export driven firms, we’ve IDA Ireland making the case for why international organizations should choose Ireland. We’ve also Local Enterprise Offices and numerous privately run business support platforms. Collectively, that’s quite strong. In terms of financial support, it might be the case that not every fintech can avail of financial support depending on its business model, but a lot of times they can receive other forms of support. One of the big supports other than money which firms need at the moment is simply access to other people’s intellect, i.e. mentors who can introduce them to people that can ease some of the pain. Ireland has a good number of angel investors that are looking to invest in the right product, companies and people. We have the Halo Business Angel Network that meets on a regular basis. They vet a number of firms. A selection of those firms will go before a group of experienced investors. There could be 10 to 12 angel investors in the room and an investor might decide to invest or indeed a group of investors might see a good idea and say it’s better and less risky if they clubbed together and invest collectively in an initiative. All the options are here in Ireland. I might hear a complaint sometimes from someone saying there’s no initiative available to me. I think a lot of that comes down to the individual or the company’s lack of research. Google search is an amazing tool. And if you Google what you’re looking for, you will find it. It might then be a confidence issue, but I also think we have to be really careful when it comes to investment and risk, because when it’s the Irish State’s money going into a company, that’s my money as a taxpayer going into it. If that company collapses, that’s my money gone. If IDA Ireland arranges financial or other incentives to a big international company to come into Ireland, and they come in for a few years and then close everything down after taking our tax breaks, that’s my money gone, because I subsidized those tax breaks. It’s right that we’re now becoming a lot more rigorous in the way that we look at providing support. But if a company needs support, and it has a genuine business plan for how they’re going to utilize the support, Ireland is a great place to establish. BF: What new up-and-coming players are we now seeing in the fintech sector that are shaking up the market? Peter Oakes: Sometimes the ‘new ones’ are firms simply doing boring old stuff a lot better. In terms of boring sectors, payments for example, has been around for hundreds if not thousands of years. In terms of banks, if you joined a bank 30 years ago and you worked in the payments team, you worked in the basement of the bank’s building. Today payments are on the front page in the strategy section of banks’ annual report. Banks can’t get enough of being in the payments arena. To me, corporate B2B payments, where transferring value generally takes a lot of time and a lot of expense to move money from company A to company B via a bank remains an exciting area. This has led to a lot of paytech companies setting up here. TransferMate, established by Irish serial tech entrepreneur Terry Clune, is a prime example of that in the B2B value transfer chain. Optal Financial Europe, recently acquired by American Bank WEX Inc., is a prime example of fintech in the travel industry providing virtual account numbers to corporates. We have some other very interesting examples, like Deposify. It’s an Irish start-up fintech that found a faster way to grow by establishing in the USA. It solves a key problem between a landlord and tenant which essentially comes down to one word, which is ‘trust,’ followed by the another word, which is ‘bond.’ Renters have to pay a financial deposit to landlords and then have to trust the landlord to return it when the rental lease comes to an end. Deposify is an escrow-as-a-service for landlords and tenants. It was acquired by a private equity firm in early 2022 and sold again to ‘proptech’ company Rhino in America which has about 15% of marketshare right now. This small Irish fintech was born here but decided to scale overseas where it found its success and a bevy of suitors. The opportunity for Deposify is huge: some $45 billion in cash deposits and security deposit insurance for 43 million rental homes across the USA. For those who think ‘fintech’ is just about young whiz kids with jazzy presentations and cool apps, Deposify is a refreshing reminder that Ireland nurtures entrepreneurs of all ages and backgrounds. One of its founders, Jon Bayle, is experienced lawyer who used to work in the corporate department of a leading law firm. Another great result for an Irish fintech is Global Shares. It developed an employee share scheme technology platform. Again, it is a traditional service that was super-charged through technology and innovation. The way it operates is that say you and I are employees of a company which, in addition to our salaries, offers us part of the long term value of the business by giving us shares in the company. The ownership and rights to those shares have to be recorded and managed somewhere. You may want to sell your shares at a certain point of time once vested, or your employer might be bought out by a competitor. Regardless, the ownership and transfer rights of your shares are managed for you and your employer. Global Shares was acquired by JP Morgan in 2022. This relatively small company set up in Clonakilty, County Cork in Ireland was acquired for $750 million (€665 million). JP Morgan probably already has its own employee share scheme service; it’s probably very happy with it. I suspect JP Morgan wants that business for the fact that it can be easily replicated in the investment services world. BF: How much of an impact have American companies had on Ireland’s financial services market, and what kind of new opportunities are we seeing that potential US or foreign investors might be interested in? Peter Oakes: It’s still the traditional areas of payments. There are a lot of American companies setting up here in terms of payments, BlueSnap being just one an example of that, along with Coinbase and the Winklevoss twins’ firm Gemini. But some of the more interesting areas are going to be around the areas of digital assets and blockchain. We are seeing more and more North American, but particularly USA firms, focused on blockchain and distributed ledger technology that can be built out of Ireland, such as Fidelity Digital Assets. They see the rationale taking advantage of Ireland’s and the EU’s intellectual property laws regime and asset protection. There’s also what is known as the ‘knowledge development box,’ a corporation tax relief entitling a company to a deduction equal to 50% of its qualifying profits. Put more simply, those profits are taxed at an effective rate of just 6.25%. Big American banks that act as custodians to mutual funds are telling Fintech Ireland that their client base is asking more and more for the ability to invest or hold investments in crypto currency and other forms of digital assets. Mutual funds in America are rightly subject to regulations about where mom and dad investors should not put their retirement savings into, like high risk and low-quality investments. But in every investment fund there is generally an opportunity for a small amount of money to be invested in what is called ‘alternative investments’ and higher risk areas. If you think about 15 years ago, hedge funds were considered to be very risky. I’m not saying that all of them aren’t now, but they’re considered not to be as risky as they were once considered to be. We understand more about them and correlation today. There are more cyclical controls and regulations governing hedge funds too. You’re now seeing demand from people saying, “I want to get involved into digital assets and crypto assets” and other things like that. The investment management companies and divisions within the banks which provide that service can only do so if there is another financial entity acting as a custodian, i.e. legal owner of the assets for the benefit of the investors. If custodian banks don’t wish to own the asset, then that investment can’t happen. What you’re seeing now are some big players, like Bank of New York Mellon, State Street and Fidelity already servicing the market. Many others too such as Blackrock, Goldman Sachs and JP Morgan are saying “let’s go into the digital asset space” and are setting up their own digital asset teams. It may only be a small figure of the entire investment pool which goes into digital assets, but whether it is 1% or 2%, that is incredible. The US mutual funds industry is the largest in the globe at an estimated $27 trillion. Imagine 2% of that money following into digital asset markets. That would be well over half a trillion dollars and more then the entire value of bitcoin today. Is there any wonder why big banks and institutional investors are eyeing up the scale of opportunities in digital assets? In Ireland many people don’t realize that we are home to $4 trillion of assets stored in mutual funds. That money isn’t pension funds and investments of Irish people; it’s coming from America, it’s coming from Australia, it’s coming from Europe. In addition, Ireland prepares the books and records of funds worth close to a €6.5tn through a thriving fund administration sector. Fintech can positively exploit out a lot of efficiencies and additional vale here. The whole area of investment funds is remarkable, andfurther innovation is required to take advantage of the immense opportunity presented. The reason I’m really passionate about this is because I am the chairman of a regulated Irish investment advisor, AWM Wealth Advisers. We look after the investment needs of expats around the world. If you’ve worked in four or five different countries, you’ve got four or five different pots of pension money from four or five different employers. You don’t know where you’re going to retire, it could be Portugal, Spain, the UK, or America. If you make the wrong choice about where you’re going to retire and have your funds in the wrong jurisdiction, that’s going to be very expensive and you can lose up to 40% of all the money that you put away. We’ll help you, we’ll give you advice, we won’t move the money nor invest it for you; we’ll tell you what your options are, the types of investment strategies that should be suitable for you in your circumstances and introduce you to money managers. The rest is up to you, but we will work with you each step of the way. You’ve got companies that are already innovating in this space that make it easier for people to see their future retirement benefits. We will be joining them in providing a seamless fintech experience for our customers across the globe. Why? Because it makes sense. It reduces friction and because today’s tech savvy clients are demanding it. BF: You’ve worked in Ireland’s financial services sector for a long time and have been a huge promotor of its fintech capabilities. You were formerly a central bank enforcement director and served as non-executive director of fintechs TransferMate, Optal and Susquehanna. Peter Oakes: I’m a non-executive director for three fintechs* — TransferMate, Optal Financial Europe and Susquehanna — and I’m also the chair of AWM Wealth Advisers, which I am planning to have join the fintech movement. My time at the Central Bank of Ireland was as the Director of Enforcement and AML Supervision, and I sat on the senior executive team. I was asked to join in 2010 as one of half a dozen senior people. In addition to putting out fires and holding banks and individuals to account for their actions leading up to the banking crisis in Ireland, I learned a lot about regtech and legaltech, the marriage of regulation administration and tech and law and tech, particularly in the area of e-discovery and electronic forensics. I also saw firsthand how to build suptech, or supervisory technology, which allows resourced constraint regulators to carry out better supervision with fewer resources. In that period of 2010-2013, we also saw the rise of fintech and crypto in the UK, the US and elsewhere. It has been very interesting to watch and oversee the regulated fintech industry from its early stages, to work in it on a day-to-day basis to where it is today. The trajectory is staggering. BF: What kind of future do you see possible for Ireland’s fintech sector, and what hurdles does it need to overcome to reach its true potential? Peter Oakes: Whether we like it or not, everything in fintech is moving towards being regulated. If your fintech poses a risk to financial stability, the integrity of financial markets, or to consumer protection, or to the detection and prevention of financial crime, then you will need to be regulated, notwithstanding that you may have state of the art controls to mitigate such risks. The opportunity for Ireland is to make sure that it has a very well understood and clear narrative out there, one that explains why Ireland is a great place to do business when it comes to some of the issues about which we’ve already spoken. What we haven’t spoken about is the perception of regulation in Ireland. The perception of regulation in Ireland obviously depends on who you are and your experience. Having been in the Irish central bank at probably the most interesting time of its existence, I ran the enforcement investigations directorate, doing all the investigations to banks, financial companies and their management. You learned a lot about good and bad practices. The regulator in place at the time leading up to the crisis was subject to a number of far-reaching reviews (at least three important reports were written on it), and those reports concluded that the regulators were not as assertive as they should have been. I think ‘timid’ is better word. Having experienced the crash, having been called out for their role and the public and political backlash I believe has caused regulators and central banks all over the world, not just in Ireland, to swing too far to conservatism in their approach. It is always a question of balance. However there is a growing perception that many of them are closed for business, particularly to innovative fintech with many arguing that they really do not understand nor wantto understand innovative fintech. In Ireland, we heard many voices complaining that following the UK’s vote for Brexit Ireland missed a golden opportunity to get those UK fintech and financial companies to establish an EU home in Ireland. Although I have some sympathy for that view on a case by case basis, I think I would call out favorably Sharon Donnery, the current Deputy Governor of the Central Bank of Ireland, who said that Ireland needs to be really careful about getting into a race to the bottom just to win business. In other words, simply because one jurisdiction in Europe will make lower regulatory standards to attract business, does that make it the right thing for Ireland to do given that it was just over a decade ago the collapse of Irish banks cost Irish taxpayers a conservate estimate of €64 billion? That bill arose simply because of bad bank behavior, willful political blindness, and poor oversight by the then central bank and regulator. We don’t want to see that again in Ireland, ever! Having said that, there is a way that regulators can support financial services and fintech. In Ireland the central bank does not have a statutory mandate to undertake such promotion. And that’s what many central banks will tell you. However, the Irish central bank can promote Ireland by being a rigorous, robust and well respected regulator, one that you want your company overseen by because it strengthens your reputation with your customer base, investors and key stakeholders. To me, that’s the point that we’re not getting across strongly enough in Ireland and overseas. Is it damaging us? I wouldn’t go that far. There have been some opportunities that we have probably missed, that would have been nice to have got if only the narrative and messaging was better, but there were some near misses that I am also glad that we missed. You’re not going to find in Ireland a FTX type debacle because that firm would not have made it off the starting blocks with the regulator. Not such a bad thing in hindsight, eh? Ireland has a very conservative approach to crypto assets presently, but it appears that more than 60 digital asset firms have applied for licenses in Ireland, ranging from the basket cases, the crypto speculators, through to well-resourced and funded digital asset firms grounded on good governance and risk management. Not all of those firms will get through, and those that do should hopefully be at the top end of that spectrum. That’s a big number for a small country like Ireland, and down the track when the Markets in Crypto Asset Regulation (MiCA) comes into law, regulated digital asset firms will be able to passport across the European Union. Our fellow member states will not be too happy if Ireland authorized a bad actor which is then let lose in their backyards. The reputational damage for Ireland would be problematic to say the least, just like Wirecard was for Germany and FTX is for the Bahamas. There is also a small but growing problem of less than reputable consulting firms and legal firms overseas which are ill-advising inexperienced fintech companies on their go-to-market strategies. Some of these firms claim to have a connection to Ireland when they do not, and after they have caused damage and let down the fintechs, we end up receiving calls for help at Fintech Ireland. There is nothing we can do. The fintech was scammed and there is no recourse. There is no regulator for that unfortunately. We’ve built a very strong and well-recognized reputation in the funds industry and deservedly so. International insurance and reinsurance are areas, too, where Ireland excels. However, while we have a good and strengthening reputation in international banking, we don’t have the same scale as some of competitors. We’re also doing things slightly differently than what other jurisdictions do when it comes to vetting international retail banks. On the fintech front, we haven’t had any blowups in the areas of payments and electronic money, but like any other jurisdictions, from time to time, you will expect to see an administrative regulatory fine with a clear explanation for the reason, or a tough letter sent by the regulator saying that you’ve got to improve your practices. But to me, that’s a good thing, a good reason for setting up in Ireland. If that’s not appreciated, then people will get in front of that and make up a narrative such as, “Ireland is too tough. Why do you want to go there?” Actually, Ireland’s robust supervision is probably what your customers want you to have, that’s what they expect from you when you are entrusted with their money. Shouldn’t you expect the same from your supervisor? BF: Do you have any final message for readers of the USA Today? Peter Oakes: The opportunities, for all the reasons I’ve mentioned, demonstrate a really strong and continuing connection between the US and Ireland; the history of our countries, the cultural and family ties is what got us here. But today it’s equally about what the business opportunities are. If you are an American firm and you want to conquer the continent of Europe, you have to be in Europe, therefore Ireland as your home base is your passport across the rest of Europe. But you can’t forget about the UK; you’ve got to be in UK too to conquer the continent. You’ve got to be in at least one member state in the European Union too. So why not Ireland? There’s our common law legal system, English speaking first language for business, ease of doing business and a common travel area and talented workforce. It’s the ideal package for international American banks, investment firms, funds and, of course, fintech that want a Europe home. * Note - since the time this article appeared in January 2024, Peter Oakes is now an INED on the boards of five (5) regulated fintech companies operating from Ireland: Interpay Ltd (t/a TransferMate), Optal Financial Europe, Susquehanna International, Ramp Swaps (Ireland) and Legend Financial Ireland.

Back to Blog

Global Government Fintech Lab 2024 panel session one: Siobhan Benita (moderator), Karen Cullen, Dominik Freudenthaler, Peter Oakes and Robert Rampre | Credit: Deirdre Brennan for Global Government Fintech. The panel for the ‘Governments and ntech: on the right path?’ session comprised: Karen Cullen, who heads a ntech steering group alongside her principal role as head of international nancial services in Ireland’s Department of Finance; Dominik Freudenthaler, ntech expert in Austria’s Federal Ministry of Finance; Peter Oakes, the founder of independent network Fintech Ireland; and Robert Rampre, undersecretary in the insurance and capital market division at Slovenia’s Ministry of Finance.

Regtech Oakes began by referring to Freudenthaler’s examples, pointing out that the rollout of digital government services would typically involve multiple elements of back Peter Oakes (second from right in photo above) at Global Government Fintech Lab 2024 end technology powered by private-sector innovation. “I ask: would any of those [innovations] actually have been achievable if there hadn’t been regulatory technology [RegTech] applications that were doing the verification of customers who wanted to open bank accounts? Without that, the innovation in government to improve public services may not have happened at the rate that it did,” Oakes (who also appeared at last year’s Lab: on a panel discussing data) said. Global fintech investment decline Oakes concluded by highlighting the IMF working paper’s conclusion on the relationship between fintech and economic growth. The paper, based on analysis of 198 countries’ data between 2012 and 2020, stated that: ‘Looking forward… fast-growing fintech is likely to have a greater effect on economic growth. In this context, maintaining financial stability is sine qua non for sustainable growth and that requires strong regulatory institutions, better use of technology in regulation, extensive cross-border coordination and appropriately calibrated prudential regulations for a level playing eld and effective monitoring and supervision of traditional and emerging financial institutions.‘ Sandbox dilemma Oakes stated that while sandboxes may often benefit nascent innovators, they are also help established companies that “want to keep an eye on younger players that might ‘disrupt’ them out of business.” “It depends on what the sandbox is going to do, how it’s going to be measured and how transparent it will be with its findings,” Oakes continued. “I do think that, overall, if there’s a budget and resources, it should be created. But I think those who run sandboxes need to prepare [their expectations] that they may not be inundated from day one with applications.” Read more - Website: here and PDF: here

Back to Blog

Access White Paper Here

In the not too distant past, senior management within financial institutions may have regarded failure to comply with anti-money laundering (AML) requirements as low impact. The 2007/8 financial crisis as well as subsequent scandals in financial services have shown the error of this approach. When it comes to AML, the current COVID-19 crisis may pose an evolving and unpredictable threat. To avoid a repetition of the previous mistakes, financial institutions must now put into practice lessons learned from the past; the most urgent one in my book, is that institutions should be adopting a culture of compliance with a ‘live and breathe’ approach to regulatory requirements. In a recent article in the Economist, Jürgen Stock, secretary-general of Interpol, was quoted as saying that COVID-19 may create the ideal conditions for the spread of serious, organised crime. Moreover, Mr. Stock believes that the immanent global economic depression will offer these criminals a chance to extend their reach deep into the legitimate economy. As COVID-19 motivates criminals to evolve their operations, those responsible for stanching the flow of ill-gotten gains into the legitimate economy must stay one step ahead; and this includes financial institutions with their AML obligations. I recently published a white paper on the lessons to be learned from the last financial crisis. For those interested in how a culture of compliance can address complex misconduct relating to AML, this paper is well worth a read. Through reviewing a number of high-profile case studies, I come to the conclusion that at the heart of many AML failures is an institutional culture that treats AML training and procedures as merely means to meet regulatory requirements. The case studies show that these banks failed to ‘live and breathe’ regulatory requirements and that the institutional culture prioritised compliance as merely a tick the box exercise, thereby failing to communicate to employees the priority of compliance and the flexibility of decision making and behaviour that may be necessary to fulfil their AML requirements. Culture is a complex issue. For those interested in how RegTech can enable an examination of institutional culture, through diagnostic tools, the white paper is a must read. In the paper, I explore how The Mizen Group, a RegTech firm based in New York, has developed a suite of tools to help boards and their compliance officers assess the extent to which their institution demonstrates the characteristics of an organisation with a strong compliance culture. The financial crime threats posed by COVID-19 mean that now is the time to commit to a culture of compliance from the ground up. Launderers and criminals are capitalising on the chaos created in the wake of the pandemic and are seeking ways to out-manoeuvre the financial institutions who are generally playing catchup. In response, board of directors and executive management need to be proactive and flexible in their thinking and develop a ‘live and breathe compliance’ mentality. This will only occur in a healthy compliance culture, wherein employees are empowered to internalise the importance of complying for the right reasons. The first step towards the goal of a healthy compliance culture might be employing tools like Mizen’s innovative culture diagnostics to assess their institutions’ cultural strengths and weaknesses. Feel free to contact the RegTech experts at The Mizen Group for further information. Access White Paper Here This blog also appears at https://complireg.com/blogs--insights.html

Back to Blog

Why would one start an article about fintech referencing Covid-19? The fact is that the virus is acting as both a headwind and tailwind for fintech companies operating from Ireland and internationally. The impact of the virus over the last month and a half on fintech has shone a spotlight on many aspects of the ecosystem that might not have otherwise come to our attention. In the current climate Ireland must also be mindful of any potential slippage of its position as a global fintech player garnered from recent years of excellent work. Let’s start with an overview of fintech. The word fintech came to prominence after the last financial crisis, particularly noticeable from 2012 onwards. Yet there were many examples of ‘financial technology’, shortened to “fintech”, existing well before the start of the last financial crisis. A number of these fintech businesses date back to the latter part of the 1980’s. Examples include the internet and phone retail bank First Direct (a division of HSBC) which kicked off in 1989 and today regularly achieves high satisfaction rates in financial surveys. Ireland too served as HQ to a pioneer challenger bank, First-e, which despite great promise was a casualty of the dot.com boom. What does the Irish fintech scene look like? The consensus is that Ireland is home to somewhere between 220- 250 indigenous fintech companies and that together with international fintech companies in Ireland, the number is probably around 400. It is difficult to give an exact figure if only because the word “fintech” is a broad-church.

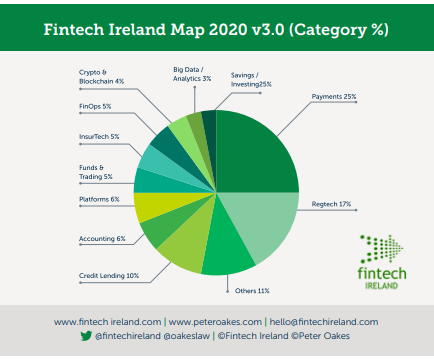

The word captures, (a) the new nonbank disruptors which focus on discrete parts of the banking value chain, e.g. payments, wealth management, treasury services and credit and lending; (b) the new breed of digital only (non-branch) challenger banks entering both retail and business banking; and (c) the incumbent banks (sometimes referred to as legacy banks) embarking - with various degrees of success – on digital transformation journeys. The recent release in April of the 2020 edition of the Fintech Ireland Map4 identified 230 indigenous / Irish controlled fintech companies. This was an increase of 30% from the previous year. The Map is supported by both research and a survey. The criteria to meet to join the Map is challenging. Entrants must be fintech companies with a proprietary product or service. Broadly speaking the fintech companies operate across 12 categories, being Credit & Lending; Platforms; Funds & Trading; Crypto & Blockchain; FinOps (Financial Operations); InsurTech (Insurance Technology); Accounting; Payments; RegTech (Regulatory Technology); Savings / Investing; Big Data / Analytics; and Others. The number of firms in each category is shown in the diagram below. IF YOU LIKE WHAT YOU HAVE READ SO FAR, CONTINUE READING AT THE SOURCE (FREE - NO ADS) AT COMPLIREG

Back to Blog

UK fintech and financial services, it's time to advance plans to establish a presence in Ireland!

See:

The Irish Government is to restart preparations for a no-deal Brexit, Ministers will be told today, as negotiations between the UK and EU on a trade deal show little signs of progress. Ireland's second most senior Minister will brief the Irish Cabinet on the state of the negotiations in Brussels, and tell Ministers that preparations at ports and airports will need to be stepped up as Ireland emerges from the coronavirus lockdown. Mr Coveney will outline two potential scenarios that could unfold in the second half of the year: either the two sides reach a “basic” free trade agreement that includes zero tariffs and zero quotas on goods, including fish, or they fail to reach agreement, in which case a no-deal Brexit will come into operation at the beginning of 2021. If there is a no-deal Brexit, Ministers will be told, Irish agrifood exports to the UK could be hit with some €1 billion in tariffs. UK Extension? The UK must decide by the end of June if it wishes to seek an extension to the present transition phase, during which, although legally outside the EU, the UK applies the laws and receives the benefits of the EU single market. However, the UK government has said it will not under any circumstances apply for an extension, meaning there are just seven months left to reach a comprehensive free trade agreement. Such a process normally takes several years. There has been little progress so far in the negotiations, which began in March, and Mr Coveney is likely to offer a gloomy prognosis to Ministers when they meet today. Of the four negotiating rounds scheduled to take place before the end of June, three have been completed, but they have achieved little agreement on anything of substance. The next round starts next week. https://www.irishtimes.com/news/politics/irish-planning-for-no-deal-brexit-to-restart-as-eu-uk-talks-go-badly-1.4265185

Back to Blog

Australian Bank giant Westpac is expecting to fork out more than $1 billion as a result of its money laundering scandal and admitting to 23 million anti-money laundering breaches.

It's not just story about culture, conduct risk and financial crime risks. Far more importantly, it is a story of shame, leadership failure and financial pain for Westpac and relief for another Aussie bank. The fine would be the biggest corporate fine in Australian history. Westpac has revealed it expects the ongoing AUSTRAC investigation will cost it $1.03 billion. Such a fine will represent about 15% of the bank's 2019 profit. Shame: In November last year AUSTRAC, the entity responsible for preventing financial crimes, said the bank had violated anti-money laundering and counter-terrorism laws more than 23 million times (which the bank admits), allowing money tied to child exploitation in south-east Asia to flow freely. For example, Westpac's system was used by paedophiles to send money to the Philippines to pay for child abuse material without raising any red flags. Notwithstanding Westpac's admission, the bank is not going down without a fight. In the 57-page defence document filed with the court, Westpac denied AUSTRAC'S accusation that it failed to identify activity indicative of child exploitation risks. Leadership Failure: The scandal brought down Westpac's leadership, forcing the resignation of chief executive Brian Hartzer and the early retirement of chairman Lindsay Maxsted. Financial Pain: Last year Australian financial press reported that a penalty or settlement of $2 billion or $3 billion would see its CET1 ratio falling below 10.5% meaning the bank would be forced into another equity raising. And the trouble doesn't stop there for Westpac as the corporate regulator, ASIC, is probing into Westpac's previous $2.5 billion equity raise. Relief: Commonwealth Bank will be delighted to pass the mantle of the indignity of Australia's current money laundering record fine of $700 million to Westpac (Commonwealth Bank was fined for systemically failing to report around 54,000 suspicious transactions made through its "intelligent deposit machines"). If you want more on the story from the media, there are updates on an almost weekly basis - soon I guess daily basis. Just use this link to keep track of the story: "Westpac Austrac money laundering fine". And add case to your case studies and typologies in your AML / CTF training for everything from CDD, transaction monitoring, risk assessment, culture, condusct risk and (lack of) crisis management. Peter Oakes, Founder, CompliReg Peter Oakes is an experience anti-financial crime, fintech and board director professional. He served as Ireland's first Director of Enforcement and Financial Crime Supervision at the Central Bank of Ireland (2010-2013) in the aftermath of the financial crisis, leading the investigation and enforcement efforts into the Irish banking industry. Peter is a regular contributor to, and moderator and panel member at, ACAMS events. |

© Peter Oakes (all rights reserved)

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.