AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

December 2025

Categories

All

|

Back to Blog

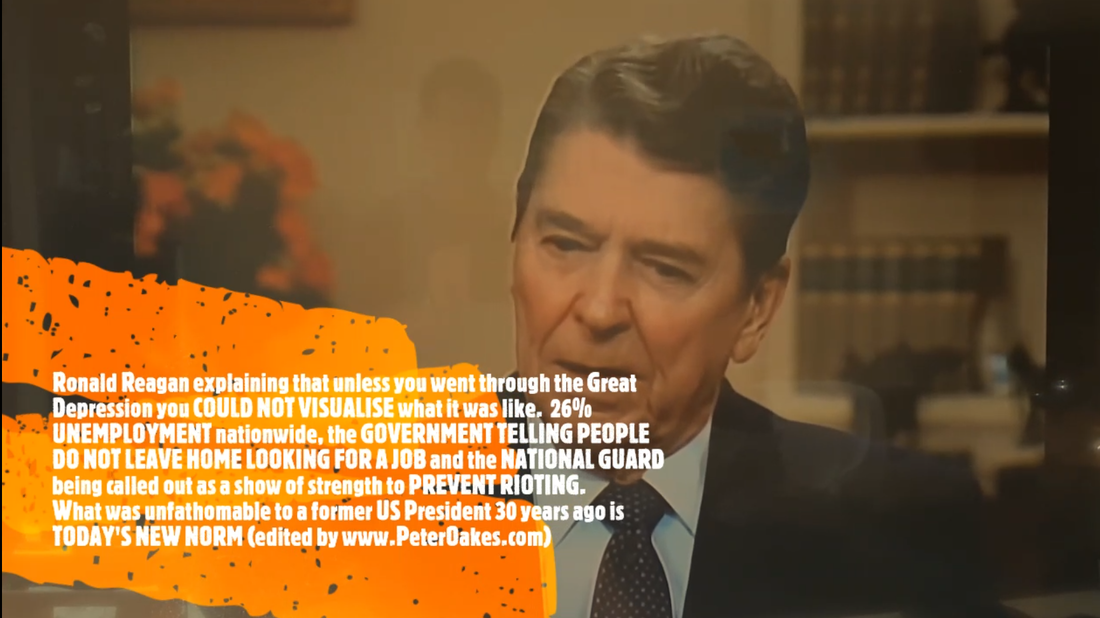

Former US President Ronald Reagan eerie interview - parallels with Covid19 & George Floyd riots30/5/2020 At some point my post today on Linkedin will disappear of an interview of former US President (1981-1989) by Tom Brokaw from the Reagan Library which I located on Youtube. Ronald Reagan explaining that unless you went through the Great Depression you COULD NOT VISUALISE what it was like. 26% UNEMPLOYMENT nationwide, the GOVERNMENT TELLING PEOPLE DO NOT LEAVE HOME LOOKING FOR A JOB and the NATIONAL GUARD being called out as a show of strength to PREVENT RIOTING. What was unfathomable to a former US President 30 years ago is TODAY'S NEW NORM (edited by www.PeterOakes.com / Peter Oakes)

0 Comments

Read More

Back to Blog

UK fintech and financial services, it's time to advance plans to establish a presence in Ireland!

See:

The Irish Government is to restart preparations for a no-deal Brexit, Ministers will be told today, as negotiations between the UK and EU on a trade deal show little signs of progress. Ireland's second most senior Minister will brief the Irish Cabinet on the state of the negotiations in Brussels, and tell Ministers that preparations at ports and airports will need to be stepped up as Ireland emerges from the coronavirus lockdown. Mr Coveney will outline two potential scenarios that could unfold in the second half of the year: either the two sides reach a “basic” free trade agreement that includes zero tariffs and zero quotas on goods, including fish, or they fail to reach agreement, in which case a no-deal Brexit will come into operation at the beginning of 2021. If there is a no-deal Brexit, Ministers will be told, Irish agrifood exports to the UK could be hit with some €1 billion in tariffs. UK Extension? The UK must decide by the end of June if it wishes to seek an extension to the present transition phase, during which, although legally outside the EU, the UK applies the laws and receives the benefits of the EU single market. However, the UK government has said it will not under any circumstances apply for an extension, meaning there are just seven months left to reach a comprehensive free trade agreement. Such a process normally takes several years. There has been little progress so far in the negotiations, which began in March, and Mr Coveney is likely to offer a gloomy prognosis to Ministers when they meet today. Of the four negotiating rounds scheduled to take place before the end of June, three have been completed, but they have achieved little agreement on anything of substance. The next round starts next week. https://www.irishtimes.com/news/politics/irish-planning-for-no-deal-brexit-to-restart-as-eu-uk-talks-go-badly-1.4265185

Back to Blog

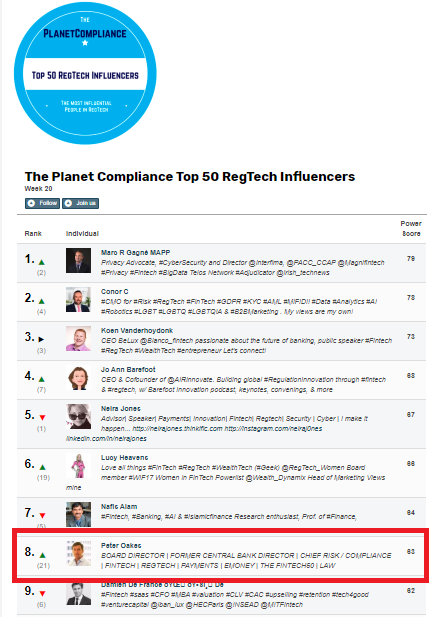

Thanks CompliReg for the shout out - https://complireg.com/blogs--insights/peter-oakes-in-top-10-regtech-influencers-planet-compliance

Back to Blog

Australian Bank giant Westpac is expecting to fork out more than $1 billion as a result of its money laundering scandal and admitting to 23 million anti-money laundering breaches.

It's not just story about culture, conduct risk and financial crime risks. Far more importantly, it is a story of shame, leadership failure and financial pain for Westpac and relief for another Aussie bank. The fine would be the biggest corporate fine in Australian history. Westpac has revealed it expects the ongoing AUSTRAC investigation will cost it $1.03 billion. Such a fine will represent about 15% of the bank's 2019 profit. Shame: In November last year AUSTRAC, the entity responsible for preventing financial crimes, said the bank had violated anti-money laundering and counter-terrorism laws more than 23 million times (which the bank admits), allowing money tied to child exploitation in south-east Asia to flow freely. For example, Westpac's system was used by paedophiles to send money to the Philippines to pay for child abuse material without raising any red flags. Notwithstanding Westpac's admission, the bank is not going down without a fight. In the 57-page defence document filed with the court, Westpac denied AUSTRAC'S accusation that it failed to identify activity indicative of child exploitation risks. Leadership Failure: The scandal brought down Westpac's leadership, forcing the resignation of chief executive Brian Hartzer and the early retirement of chairman Lindsay Maxsted. Financial Pain: Last year Australian financial press reported that a penalty or settlement of $2 billion or $3 billion would see its CET1 ratio falling below 10.5% meaning the bank would be forced into another equity raising. And the trouble doesn't stop there for Westpac as the corporate regulator, ASIC, is probing into Westpac's previous $2.5 billion equity raise. Relief: Commonwealth Bank will be delighted to pass the mantle of the indignity of Australia's current money laundering record fine of $700 million to Westpac (Commonwealth Bank was fined for systemically failing to report around 54,000 suspicious transactions made through its "intelligent deposit machines"). If you want more on the story from the media, there are updates on an almost weekly basis - soon I guess daily basis. Just use this link to keep track of the story: "Westpac Austrac money laundering fine". And add case to your case studies and typologies in your AML / CTF training for everything from CDD, transaction monitoring, risk assessment, culture, condusct risk and (lack of) crisis management. Peter Oakes, Founder, CompliReg Peter Oakes is an experience anti-financial crime, fintech and board director professional. He served as Ireland's first Director of Enforcement and Financial Crime Supervision at the Central Bank of Ireland (2010-2013) in the aftermath of the financial crisis, leading the investigation and enforcement efforts into the Irish banking industry. Peter is a regular contributor to, and moderator and panel member at, ACAMS events. |

© Peter Oakes (all rights reserved)

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.