AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

December 2025

Categories

All

|

Back to Blog

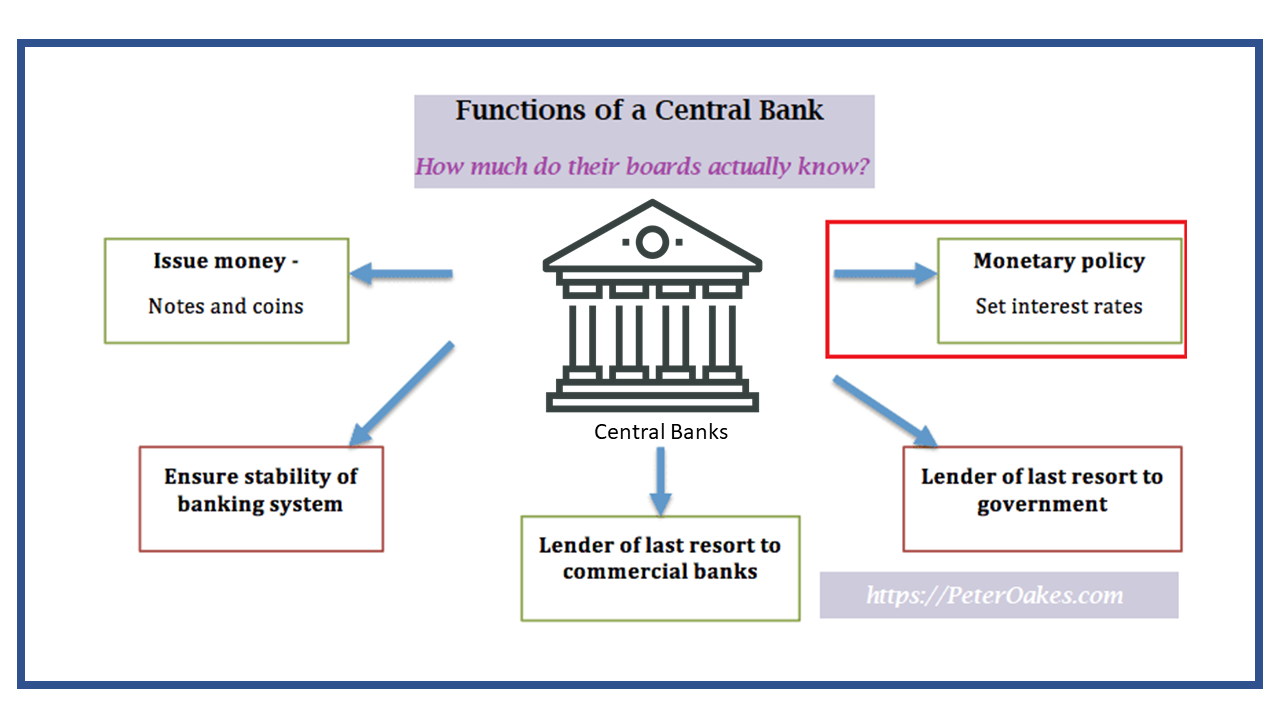

"Decision makers seem hostile to a consideration of evidence or research". This post relates to the Reserve Bank of Australia board, which has been lashed by a former researcher for failing to understand monetary policy in an email made public. Many of the points raised could be levied at other central banks too. As central banks continue to claim immunity from scrutiny under a misguided cloak of a widely misunderstood principle of 'central bank independence', which applies to some but not each and every aspect of a central bank's remit, we should expect to see more criticism of them particularly:

On the 2nd last point, it is welcome reading that in the case of the Australian central bank the damning email was released by the bank following a freedom of information request. This is not something one could expect from many European central banks. The email also criticised the central bank for:

Here's a link to the Australia article on Reserve Bank Here's the link to Stefan Gerlach's (former Central Bank of Ireland deputy governor) post on his 'lonesome battle against the incantations' Both are worth a read. And when you do, think about any relevance to your central bank and although there is always two sides to every story, in the absence of comment by the Australian central bank, the reports of Dr Peter Tulip's comments make for compelling reading and thinking. This article is reference in my post on Linkedin.

1 Comment

Read More

|

© Peter Oakes (all rights reserved)

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.