AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

February 2025

Categories

All

|

Back to Blog

16 January 2021: Peter Oakes has again being recognised as a leading fintech consultant for 2021 following his listing in 2020.

Chambers and Partners released its Fintech Rankings for Ireland in January 2021. Peter is the only individual / boutique professional services firm (CompliReg) to be ranked along side some of Ireland's largest consulting firms. In research carried out by Chambers and Partners, Peter's clients and fintech industry experts informed the researchers that:

Reach to Peter for assistance and advice via the details on our contact page. Further reading:

0 Comments

Read More

Back to Blog

Download Report - The Use of Supervisory and Regulatory Technology by Authorities and Regulated Institutions Market developments and financial stability implications One for all the #regtech and #suptech ambassadors / champions in the network (and you may have spotted it) - Use of Supervisory and Regulatory Technology by Authorities and Regulated Institutions covering:

As you will see in the images below and in the report, less than 50% of supervisory authorities responding to the FSB survey had a Chief Data Officer or equivalent. Areas where new RegTech tools and uses for data have been developed post 2016 are:

Whereas pre-2016, the supervisory authorities were focused on:

Future technology use by the regulator I thought the section 9.2 Future technology use by the was regulator interesting. The FSB reports that rapid changes to the financial landscape and evolving market structure could be accompanied by changes in supervisory surveillance techniques. [Oakes - Ok so that is relatively obvious] 85% + of survey respondents expect that the continued evolution of available technologies will result in changes to supervisory processes, with 68% expecting this to be a considerable change. However, authorities expressed concern that undue reliance on SupTech tools could lead to misplaced focus on areas where risks can be easily measured. [Oakes - so just because you can do something doesn't mean you should do it]. This may deflect attention from areas of concern that are not as easily given to quantifiable measurement [Oakes - so true]. Retaining a forward-looking human based supervisory process Thus while authorities may recognise the importance of integrating technology into their supervisory approaches, they could also acknowledge the importance of retaining a forward-looking human based supervisory process. The modern supervisory philosophy in most jurisdictions surveyed is based on predictive and human judgement-based oversight of regulated institutions. Technology offers the opportunity to automate routine tasks, develop new analytical techniques and provide better information. Using tools such as AI and ML to analyse increasing volumes of regulatory data provides opportunities for authorities to shift their focus to those aspects where humans excel over machines, e.g. judgement-based decision making. [Oakes- couldn't add anything further to that]. Cases Studies I also recommend a read of Annex 1 where the Case studies and examples are contained. There are case studies from 26 supervisory authorities:

Source: https://www.fsb.org/2020/10/the-use-of-supervisory-and-regulatory-technology-by-authorities-and-regulated-institutions-market-developments-and-financial-stability-implications/ https://www.fsb.org/2020/10/the-use-of-supervisory-and-regulatory-technology-by-authorities-and-regulated-institutions-market-developments-and-financial-stability-implications/

Back to Blog

Here's one for the #moneylaundering typology case studies for #MLROs as part of regulatory training requirements!

Relates to the collapse of major investigation into the Kinahan cartel and more than half a billion euros- particularly €500,000,000 stash of cars, properties & cash handed back to the accused by a Spanish judge after collapse of money laundering case. Continue reading at CompliReg by clicking here.

Back to Blog

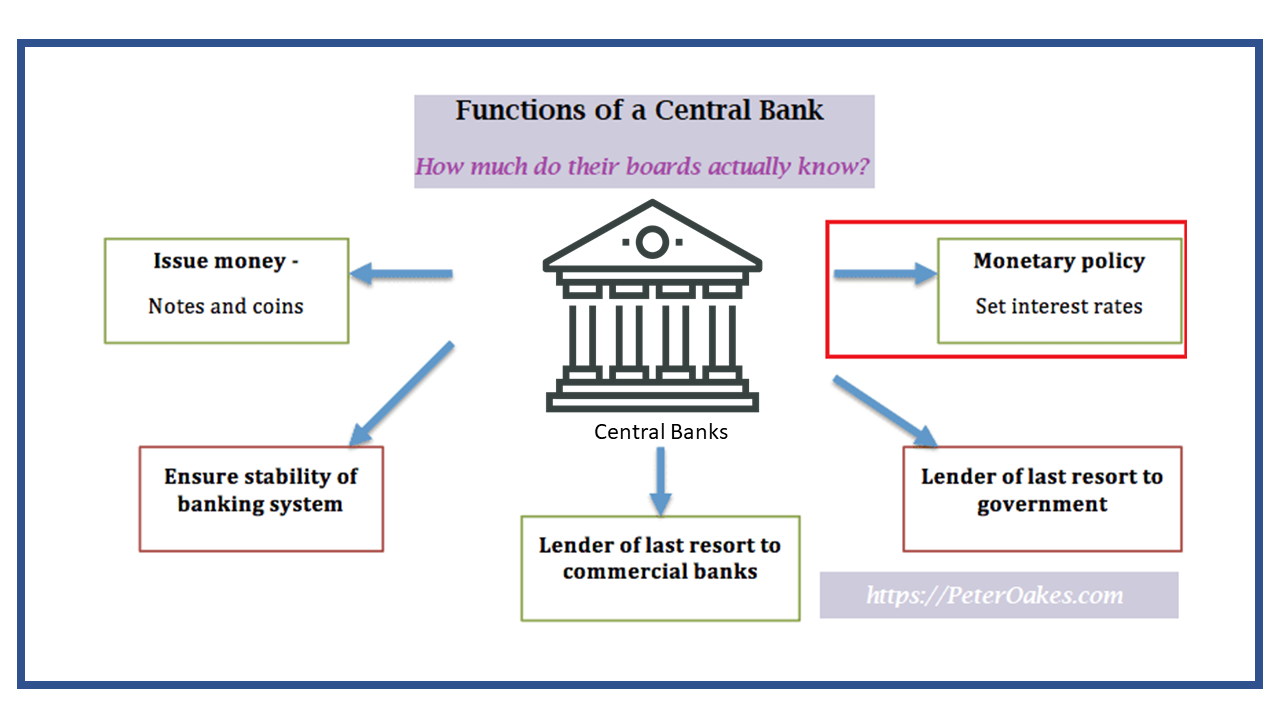

"Decision makers seem hostile to a consideration of evidence or research". This post relates to the Reserve Bank of Australia board, which has been lashed by a former researcher for failing to understand monetary policy in an email made public. Many of the points raised could be levied at other central banks too. As central banks continue to claim immunity from scrutiny under a misguided cloak of a widely misunderstood principle of 'central bank independence', which applies to some but not each and every aspect of a central bank's remit, we should expect to see more criticism of them particularly:

On the 2nd last point, it is welcome reading that in the case of the Australian central bank the damning email was released by the bank following a freedom of information request. This is not something one could expect from many European central banks. The email also criticised the central bank for:

Here's a link to the Australia article on Reserve Bank Here's the link to Stefan Gerlach's (former Central Bank of Ireland deputy governor) post on his 'lonesome battle against the incantations' Both are worth a read. And when you do, think about any relevance to your central bank and although there is always two sides to every story, in the absence of comment by the Australian central bank, the reports of Dr Peter Tulip's comments make for compelling reading and thinking. This article is reference in my post on Linkedin.

Back to Blog

Access White Paper Here

In the not too distant past, senior management within financial institutions may have regarded failure to comply with anti-money laundering (AML) requirements as low impact. The 2007/8 financial crisis as well as subsequent scandals in financial services have shown the error of this approach. When it comes to AML, the current COVID-19 crisis may pose an evolving and unpredictable threat. To avoid a repetition of the previous mistakes, financial institutions must now put into practice lessons learned from the past; the most urgent one in my book, is that institutions should be adopting a culture of compliance with a ‘live and breathe’ approach to regulatory requirements. In a recent article in the Economist, Jürgen Stock, secretary-general of Interpol, was quoted as saying that COVID-19 may create the ideal conditions for the spread of serious, organised crime. Moreover, Mr. Stock believes that the immanent global economic depression will offer these criminals a chance to extend their reach deep into the legitimate economy. As COVID-19 motivates criminals to evolve their operations, those responsible for stanching the flow of ill-gotten gains into the legitimate economy must stay one step ahead; and this includes financial institutions with their AML obligations. I recently published a white paper on the lessons to be learned from the last financial crisis. For those interested in how a culture of compliance can address complex misconduct relating to AML, this paper is well worth a read. Through reviewing a number of high-profile case studies, I come to the conclusion that at the heart of many AML failures is an institutional culture that treats AML training and procedures as merely means to meet regulatory requirements. The case studies show that these banks failed to ‘live and breathe’ regulatory requirements and that the institutional culture prioritised compliance as merely a tick the box exercise, thereby failing to communicate to employees the priority of compliance and the flexibility of decision making and behaviour that may be necessary to fulfil their AML requirements. Culture is a complex issue. For those interested in how RegTech can enable an examination of institutional culture, through diagnostic tools, the white paper is a must read. In the paper, I explore how The Mizen Group, a RegTech firm based in New York, has developed a suite of tools to help boards and their compliance officers assess the extent to which their institution demonstrates the characteristics of an organisation with a strong compliance culture. The financial crime threats posed by COVID-19 mean that now is the time to commit to a culture of compliance from the ground up. Launderers and criminals are capitalising on the chaos created in the wake of the pandemic and are seeking ways to out-manoeuvre the financial institutions who are generally playing catchup. In response, board of directors and executive management need to be proactive and flexible in their thinking and develop a ‘live and breathe compliance’ mentality. This will only occur in a healthy compliance culture, wherein employees are empowered to internalise the importance of complying for the right reasons. The first step towards the goal of a healthy compliance culture might be employing tools like Mizen’s innovative culture diagnostics to assess their institutions’ cultural strengths and weaknesses. Feel free to contact the RegTech experts at The Mizen Group for further information. Access White Paper Here This blog also appears at https://complireg.com/blogs--insights.html

Back to Blog

CompliReg, supporters of the Fintech Ireland Map, has written a short blog on the announcement (10th August 2020) that the Irish Government Cabinet has approved the publication of new draft rules which, if passed by both houses of Ireland's parliament, will strengthen existing Irish money laundering and terrorist financing laws to bring Ireland further into compliance with the 5th AML/CTF Directive.

Readers may recall that in July 2020, together with Romania, Ireland was fined €2 million for its delay in implementing the necessary legal changes to give effect to the 5th AML/CTF Directive. The blog is particularly relevant for regulated #Fintech firms, such as payment services and emoney firms, and the soon to be captured cryptoasset / cryptocurrency / cryptoexchange / cryptowallet providers operating from Ireland. More here - https://complireg.com/blogs--insights/new-irish-anti-money-laundering-rules-approved-by-government

Back to Blog

Ireland did not give Apple illegal State Aid. Wins round two in its fight with European Commission15/7/2020 Europe’s second-highest court rules today Ireland (through its tax authorities) did not give Apple illegal state aid. This overturns a European Commission decision 4 years’ ago that the iPhone maker owed the Irish taxman €13.1 billion in back taxes. Below is a text version of the PDF press release. General Court of the European Union PRESS RELEASE No 90/20 Luxembourg, 15 July 2020"General Court of the European Union Q PRESS RELEASE No 90/20 Luxembourg, 15 July 2020 Judgment in Cases T-778/16. Ireland v Commission, and T-892/16, Apple Sales International and Apple Operations Europe v Commission The General Court of the European Union annuls the decision taken by the Commission regarding the Irish tax rulings in favour of Apple The General Court annuls the contested decision because the Commission did not succeed in showing to the requisite legal standard that there was an advantage for the purposes of Article 107(1) TFEU[1] In 2016 the Commission adopted a decision[2] concerning two tax rulings issued by the Irish tax authorities (Irish Revenue) on 29 January 1991 and 23 May 2007 in favour of Apple Sales international (ASI) and Apple Operations Europe (AOE), which were companies incorporated in Ireland but not tax resident in Ireland. The contested tax rulings endorsed the methods used by ASI and ACE to determine their chargeable profits in Ireland, relating to the trading activity of their respective Irish branches. The 1991 tax ruling remained in force until 2007, when it was replaced by the 2007 tax ruling. The 2007 tax ruling then remained in force until Apple‘s new business structure was implemented in Ireland in 2014. By its decision, the Commission considered that the tax rulings in question constituted State aid unlawfully put into effect by Ireland. The aid was declared incompatible with the internal market. The Commission demanded the recovery of the aid in question. According to the Commission’s calculations, Ireland had granted Apple 13 billion euro in unlawful tax advantages.[3] Ireland (Case T-778116) and ASI and AOE (Case T-892/16) claimed that the General Court should annul the Commission's decision. By today‘s judgment, the General Court annuls the contested decision because the Commission did not succeed in showing to the requisite legal standard that there was an advantage for the purposes of Article 107(1) TFEU. According to the General Court, the Commission was wrong to declare that ASI and AOE had been granted a selective economic advantage and. by extension, State aid. The General Court endorses the Commission's assessments relating to normal taxation under the Irish tax law applicable in the present instance, in particular having regard to the tools developed within the OECD. such as the arm’s length principle. in order to check whether the level of chargeable profits endorsed by the Irish tax authorities corresponds to that which would have been obtained under market conditions. However. the General Court considers that the Commission incorrectly concluded, in its primary line of reasoning. that the lrish tax authorities had granted ASI and AOE an advantage as a result of not having allocated the Apple Group intellectual property licences held by ASI and ACE. and. consequently, all of ASI and AOE's trading income, obtained from the Apple Group's sales outside North and South America, to their Irish branches. According to the General Court, the Commission should have shown that that income represented the value of the activities actually carried out by the Irish branches themselves, in view of. inter alia. the activities and functions actually performed by the Irish branches of ASI and AOE, on the one hand, and the strategic decisions taken and implemented outside of those branches. on the other. In addition, the General Court considers that the Commission did not succeed in demonstrating, in its subsidiary line of reasoning, methodological errors in the contested tax rulings which would have led to a reduction in ASI and AOE's chargeable profits in Ireland. Although the General Court regrets the incomplete and occasionally inconsistent nature of the contested tax rulings, the defects identified by the Commission are not, in themselves, sufficient to prove the existence of an advantage for the purposes of Article 107(1) TFEU. Furthermore. the General Court considers that the Commission did not prove, in its alternative line of reasoning. that the contested tax rulings were the result of discretion exercised by the Irish tax authorities and that, accordingly, ASI and ACE had been granted a selective advantage. NOTE: An appeal, limited to points of law only, may be brought before the Court of Justice against the decision of the General Court within two months and ten days of notification of the decision. NOTE: An action for annulment seeks the annulment of acts of the Institutions of the European Union that are contrary to EU law The Member States the European Institutions and individuals may under certain conditions. bring an action for annulment before the Court of Justice or the General Court If the action Is well founded the act is annulled. The Institution concerned must fill any legal vacuum created by the annulment Unofficial document for media use, not binding on the General Court. The full text of judgement is published on the CURIA website on the day of delivery. [1] Article 107(1) TFEU ‘Save as otherwise provided In the Treaties any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favouring certain undertakings or the production of certain goods shall, In so far as It affects trade between Member States. be incompatible with the Internal market [2] Commission Decision (EU) 2017/1283 01 30 August 2016 on State and SA 38673 (2014/0) (ex 2014/NN) (ex 2014/CP) Implemented by Ireland to Apple (notified under document C(2017) 5605) [3] Commission press release of 30 August 2016 State and Ireland gave illegal tax benefits to Apple worth up to 13 billion euro.

Back to Blog

Who wants to buy a bank? Web browser Opera does as it continues inroads into banking and fintech9/7/2020 Who wants to buy a bank?It seems that web browser Opera does after announcing investment in and agreement to acquire Fjord Bank, a Norwegian capital bank established in Lithuania regulated by the Lietuvos bankas / Bank of Lithuania and the European Central Bank. Fjord Bank was founded in March 2017 and only established in Lithuania in 2019. Opera, headquartered in Oslo, Norway, announced its intention to purchase Fjord Bank subject to regulatory approval. Opera says that "The acquisition will enable Opera to further accelerate its fintech operations in Europe by launching new, disruptive services aimed at improving consumers’ personal finances." Innovative fintech in Europe and beyond could also be acquired as Opera. Opera first ventured into the fintech space in Europe acquiring Estonian fintech Pocosys which provides digital wallets, payment technology and banking-as-a-service software. At the time of the Pocosys acquisition Opera's Krystian Kolondra said "The way we use financial services is starting to change rapidly ...We see a lot of potential for better and easier services. Needless to say we are excited about our future fintech plans associated with Pocosys and our existing brand.” The Pocosys deal also included an agreement to take over its startup’s sister company which holds a payment institution license and provides financial services in the European Union. "Opera has been making innovative browsers and apps for 25 years. Our browsers are the personal choice of millions of people who prefer them over those that come preinstalled on their devices,” said Krystian Kolondra, EVP Opera. “Looking at the fintech space in Europe, we believe it needs more and bigger challengers who should provide people with smarter and empowering solutions for their personal finances." Why is Opera entering the challenger bank and fintech space?pera says that it has growing user base of more than 50 million monthly active browser users in Europe. Its move into challenger banking and fintech is owed to its current and ambition to grow its position as a top European top consumer technology. Opera is ranked 6th in terms of usage share of desktop browsers and 5th in terms of usage share of mobile browsers according to Wikipedia. Together with the acquisition of the Estonian fintech company PocoSys, the acquisition of AB Fjord Bank means Opera will become a fuller suite financial services provider. We will see soon see Opera via the acquisition of the specialized bank launching its first deposit and loan service in Lithuania this summer 2020. “We are looking forward to joining the Opera family, and accelerating its plans to grow its unique product offering”, said Veiko Kandla, CEO of AB Fjord Bank, “With the support of Opera, we are also excited to launch our first banking services in Lithuania this summer”. Further detail on the Opera and AB Fjord Bank investment and share purchase agreementOpera and AB Fjord Bank entered into an investment and share purchase agreement on May 29th 2020. Opera acquired a 9.9% interest in AB Fjord Bank via a share subscription which was completed on 3 July 2020. Completion of the acquisition of the remaining 90.1% of Fjord Bank is pending regulatory approval. An result of Opera' recent fintech activity, it has created demonstrable fintech bridge links between Norway, Estonia, Lithuania and Sweden as well as creating three European fintech hubs for fintech services in: Tallinn, Estonia; Vilnius, Lithuania; and Gothenburg, Sweden. Further reading & sources:  This blog written by Peter Oakes of CompliReg, Fintech Ireland and Fintech UK Peter advises on Lithuanian EMI/PI issues and advised on the authorisation of one Lithuania's first special bank authorisations. If you require a licence to operate in Lithuania, Ireland, Cyprus, Malta or the UK, see our Authorisation Page. We have a great network of experts in each country too, from lawyers, to accountants to technical experts. And get in contact if you have a question about this blog.

Back to Blog

Peter Oakes, Enforcement Expert & Lawyer Peter Oakes, Enforcement Expert & Lawyer Here's an enforcement action which will serve as a useful typology for fitness and probity, not to mention culture and behavior, as Ireland heads towards a Senior Executive Accountability Regime by Peter Oakes Peter is was appointed the first Director of Enforcement and Ant-Money Laundering at the newly reconstituted Central Bank of Ireland in 2010, where he led and developed the creation and staffing of the new Enforcement and Anti-Money Laundering Directorate with responsibility for delivering administrative sanction procedure enforcement actions, unauthorised providers actions, fitness and probity supervisory and enforcement actions and development of new regulatory laws. Peter has worked on a number of regulatory enforcement matters since leaving the Central Bank and is available to advise and represent on such matters. Read more here Bullet Point Summary

Continue reading this blog at CompliReg

Back to Blog

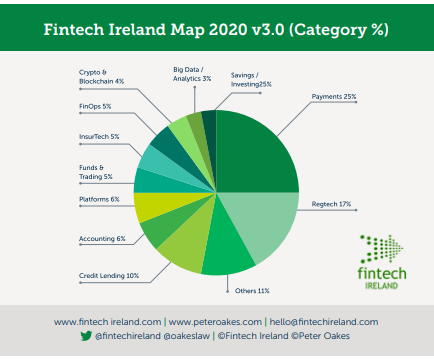

Why would one start an article about fintech referencing Covid-19? The fact is that the virus is acting as both a headwind and tailwind for fintech companies operating from Ireland and internationally. The impact of the virus over the last month and a half on fintech has shone a spotlight on many aspects of the ecosystem that might not have otherwise come to our attention. In the current climate Ireland must also be mindful of any potential slippage of its position as a global fintech player garnered from recent years of excellent work. Let’s start with an overview of fintech. The word fintech came to prominence after the last financial crisis, particularly noticeable from 2012 onwards. Yet there were many examples of ‘financial technology’, shortened to “fintech”, existing well before the start of the last financial crisis. A number of these fintech businesses date back to the latter part of the 1980’s. Examples include the internet and phone retail bank First Direct (a division of HSBC) which kicked off in 1989 and today regularly achieves high satisfaction rates in financial surveys. Ireland too served as HQ to a pioneer challenger bank, First-e, which despite great promise was a casualty of the dot.com boom. What does the Irish fintech scene look like? The consensus is that Ireland is home to somewhere between 220- 250 indigenous fintech companies and that together with international fintech companies in Ireland, the number is probably around 400. It is difficult to give an exact figure if only because the word “fintech” is a broad-church.

The word captures, (a) the new nonbank disruptors which focus on discrete parts of the banking value chain, e.g. payments, wealth management, treasury services and credit and lending; (b) the new breed of digital only (non-branch) challenger banks entering both retail and business banking; and (c) the incumbent banks (sometimes referred to as legacy banks) embarking - with various degrees of success – on digital transformation journeys. The recent release in April of the 2020 edition of the Fintech Ireland Map4 identified 230 indigenous / Irish controlled fintech companies. This was an increase of 30% from the previous year. The Map is supported by both research and a survey. The criteria to meet to join the Map is challenging. Entrants must be fintech companies with a proprietary product or service. Broadly speaking the fintech companies operate across 12 categories, being Credit & Lending; Platforms; Funds & Trading; Crypto & Blockchain; FinOps (Financial Operations); InsurTech (Insurance Technology); Accounting; Payments; RegTech (Regulatory Technology); Savings / Investing; Big Data / Analytics; and Others. The number of firms in each category is shown in the diagram below. IF YOU LIKE WHAT YOU HAVE READ SO FAR, CONTINUE READING AT THE SOURCE (FREE - NO ADS) AT COMPLIREG |

© Peter Oakes (all rights reserved)

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.