AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

December 2025

Categories

All

|

Back to Blog

Why would one start an article about fintech referencing Covid-19? The fact is that the virus is acting as both a headwind and tailwind for fintech companies operating from Ireland and internationally. The impact of the virus over the last month and a half on fintech has shone a spotlight on many aspects of the ecosystem that might not have otherwise come to our attention. In the current climate Ireland must also be mindful of any potential slippage of its position as a global fintech player garnered from recent years of excellent work. Let’s start with an overview of fintech. The word fintech came to prominence after the last financial crisis, particularly noticeable from 2012 onwards. Yet there were many examples of ‘financial technology’, shortened to “fintech”, existing well before the start of the last financial crisis. A number of these fintech businesses date back to the latter part of the 1980’s. Examples include the internet and phone retail bank First Direct (a division of HSBC) which kicked off in 1989 and today regularly achieves high satisfaction rates in financial surveys. Ireland too served as HQ to a pioneer challenger bank, First-e, which despite great promise was a casualty of the dot.com boom. What does the Irish fintech scene look like? The consensus is that Ireland is home to somewhere between 220- 250 indigenous fintech companies and that together with international fintech companies in Ireland, the number is probably around 400. It is difficult to give an exact figure if only because the word “fintech” is a broad-church.

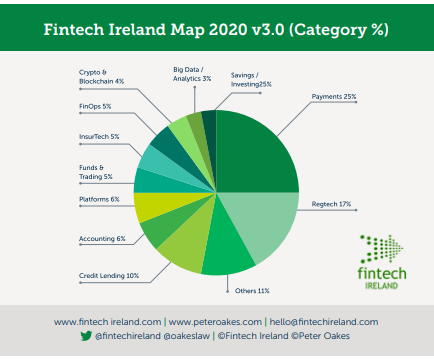

The word captures, (a) the new nonbank disruptors which focus on discrete parts of the banking value chain, e.g. payments, wealth management, treasury services and credit and lending; (b) the new breed of digital only (non-branch) challenger banks entering both retail and business banking; and (c) the incumbent banks (sometimes referred to as legacy banks) embarking - with various degrees of success – on digital transformation journeys. The recent release in April of the 2020 edition of the Fintech Ireland Map4 identified 230 indigenous / Irish controlled fintech companies. This was an increase of 30% from the previous year. The Map is supported by both research and a survey. The criteria to meet to join the Map is challenging. Entrants must be fintech companies with a proprietary product or service. Broadly speaking the fintech companies operate across 12 categories, being Credit & Lending; Platforms; Funds & Trading; Crypto & Blockchain; FinOps (Financial Operations); InsurTech (Insurance Technology); Accounting; Payments; RegTech (Regulatory Technology); Savings / Investing; Big Data / Analytics; and Others. The number of firms in each category is shown in the diagram below. IF YOU LIKE WHAT YOU HAVE READ SO FAR, CONTINUE READING AT THE SOURCE (FREE - NO ADS) AT COMPLIREG

0 Comments

Read More

Back to Blog

WATCH VIDEO HERE

Recorded for ACAMS 24+ Financial Crime Marathon (2 & 3 June 2020). This video is a discussion between Shilpa Arora, AML Director - Europe, Middle-East and Africa at ACAMS and Peter Oakes (Fintech Ireland, Fintech UK & CompliReg) on The Latest and Greatest in the World of Fintech. Sound starts at 25 seconds into video following title slides. Big thanks to ACAMS for the invitation to join such an excellent event. WATCH VIDEO HERE

Back to Blog

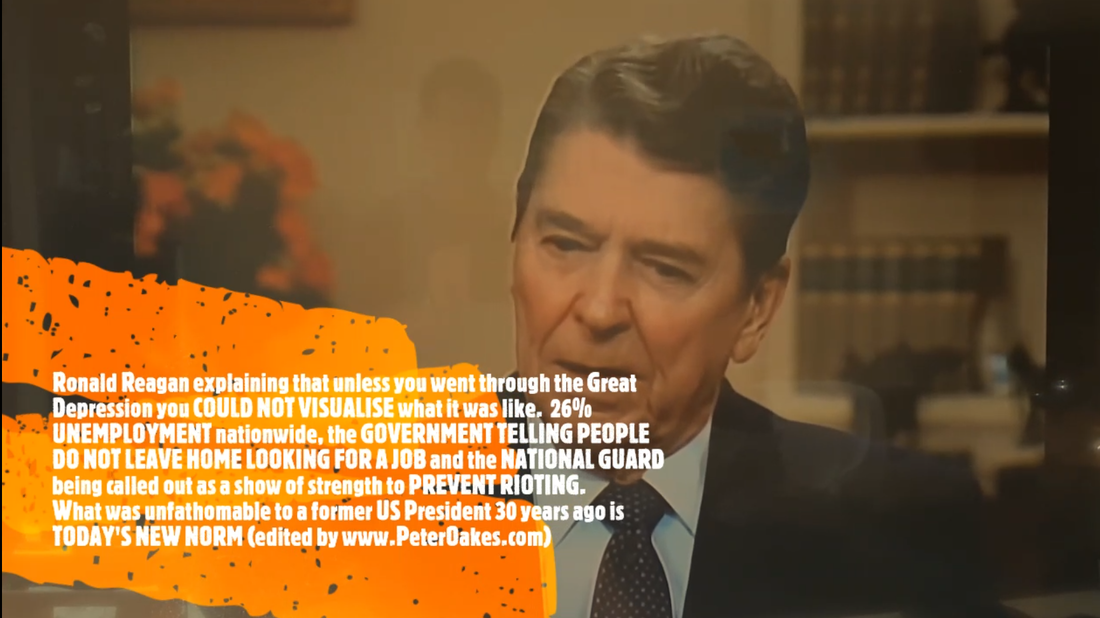

Former US President Ronald Reagan eerie interview - parallels with Covid19 & George Floyd riots30/5/2020 At some point my post today on Linkedin will disappear of an interview of former US President (1981-1989) by Tom Brokaw from the Reagan Library which I located on Youtube. Ronald Reagan explaining that unless you went through the Great Depression you COULD NOT VISUALISE what it was like. 26% UNEMPLOYMENT nationwide, the GOVERNMENT TELLING PEOPLE DO NOT LEAVE HOME LOOKING FOR A JOB and the NATIONAL GUARD being called out as a show of strength to PREVENT RIOTING. What was unfathomable to a former US President 30 years ago is TODAY'S NEW NORM (edited by www.PeterOakes.com / Peter Oakes)

Back to Blog

UK fintech and financial services, it's time to advance plans to establish a presence in Ireland!

See:

The Irish Government is to restart preparations for a no-deal Brexit, Ministers will be told today, as negotiations between the UK and EU on a trade deal show little signs of progress. Ireland's second most senior Minister will brief the Irish Cabinet on the state of the negotiations in Brussels, and tell Ministers that preparations at ports and airports will need to be stepped up as Ireland emerges from the coronavirus lockdown. Mr Coveney will outline two potential scenarios that could unfold in the second half of the year: either the two sides reach a “basic” free trade agreement that includes zero tariffs and zero quotas on goods, including fish, or they fail to reach agreement, in which case a no-deal Brexit will come into operation at the beginning of 2021. If there is a no-deal Brexit, Ministers will be told, Irish agrifood exports to the UK could be hit with some €1 billion in tariffs. UK Extension? The UK must decide by the end of June if it wishes to seek an extension to the present transition phase, during which, although legally outside the EU, the UK applies the laws and receives the benefits of the EU single market. However, the UK government has said it will not under any circumstances apply for an extension, meaning there are just seven months left to reach a comprehensive free trade agreement. Such a process normally takes several years. There has been little progress so far in the negotiations, which began in March, and Mr Coveney is likely to offer a gloomy prognosis to Ministers when they meet today. Of the four negotiating rounds scheduled to take place before the end of June, three have been completed, but they have achieved little agreement on anything of substance. The next round starts next week. https://www.irishtimes.com/news/politics/irish-planning-for-no-deal-brexit-to-restart-as-eu-uk-talks-go-badly-1.4265185

Back to Blog

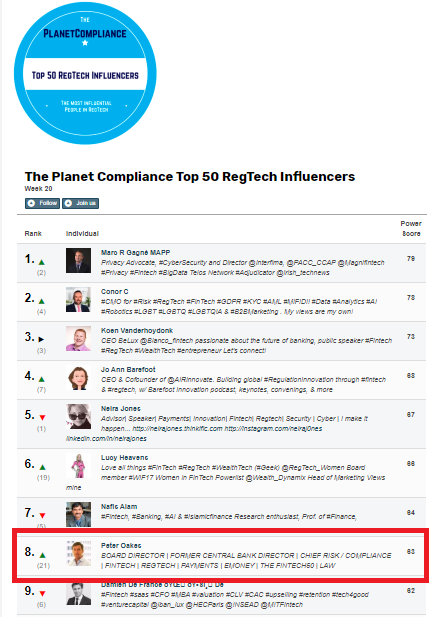

Thanks CompliReg for the shout out - https://complireg.com/blogs--insights/peter-oakes-in-top-10-regtech-influencers-planet-compliance

Back to Blog

Australian Bank giant Westpac is expecting to fork out more than $1 billion as a result of its money laundering scandal and admitting to 23 million anti-money laundering breaches.

It's not just story about culture, conduct risk and financial crime risks. Far more importantly, it is a story of shame, leadership failure and financial pain for Westpac and relief for another Aussie bank. The fine would be the biggest corporate fine in Australian history. Westpac has revealed it expects the ongoing AUSTRAC investigation will cost it $1.03 billion. Such a fine will represent about 15% of the bank's 2019 profit. Shame: In November last year AUSTRAC, the entity responsible for preventing financial crimes, said the bank had violated anti-money laundering and counter-terrorism laws more than 23 million times (which the bank admits), allowing money tied to child exploitation in south-east Asia to flow freely. For example, Westpac's system was used by paedophiles to send money to the Philippines to pay for child abuse material without raising any red flags. Notwithstanding Westpac's admission, the bank is not going down without a fight. In the 57-page defence document filed with the court, Westpac denied AUSTRAC'S accusation that it failed to identify activity indicative of child exploitation risks. Leadership Failure: The scandal brought down Westpac's leadership, forcing the resignation of chief executive Brian Hartzer and the early retirement of chairman Lindsay Maxsted. Financial Pain: Last year Australian financial press reported that a penalty or settlement of $2 billion or $3 billion would see its CET1 ratio falling below 10.5% meaning the bank would be forced into another equity raising. And the trouble doesn't stop there for Westpac as the corporate regulator, ASIC, is probing into Westpac's previous $2.5 billion equity raise. Relief: Commonwealth Bank will be delighted to pass the mantle of the indignity of Australia's current money laundering record fine of $700 million to Westpac (Commonwealth Bank was fined for systemically failing to report around 54,000 suspicious transactions made through its "intelligent deposit machines"). If you want more on the story from the media, there are updates on an almost weekly basis - soon I guess daily basis. Just use this link to keep track of the story: "Westpac Austrac money laundering fine". And add case to your case studies and typologies in your AML / CTF training for everything from CDD, transaction monitoring, risk assessment, culture, condusct risk and (lack of) crisis management. Peter Oakes, Founder, CompliReg Peter Oakes is an experience anti-financial crime, fintech and board director professional. He served as Ireland's first Director of Enforcement and Financial Crime Supervision at the Central Bank of Ireland (2010-2013) in the aftermath of the financial crisis, leading the investigation and enforcement efforts into the Irish banking industry. Peter is a regular contributor to, and moderator and panel member at, ACAMS events.

Back to Blog

16 January 2020: Peter Oakes, Founder of CompliReg (and Founder of Fintech Ireland, Fintech UK, Fintech NI and US Fintech / USTechFin) has been recognised as a Leading Band 1 Consultant in Chambers & Partners’ 2020 Professional Advisers guide for FinTech – the premier ranking of professional advisers to the financial services industry.

Peter secured a nationwide Ireland Band 1 ranking – Chambers’ top-tier ranking – where it was noted that: Peter Oakes, who has vast international regulatory experience as a former director of the Central Bank of Ireland. A source says: ‘Peter is high-profile, he has very strong governance capabilities and is very good for a regulated FinTech company.' Peter is a non-executive director of regulated fintech companies in the payments, e-money and MiFID sectors and is an adviser and mentor to fintech and regtech startups and scaleups. In Ireland he is a consultant to Clark Hill and in the UK he is a consultant to Kerman & Co, which is supporting the Fintech UK project. Learn more about Peter Oakes’s rankings in the Chambers FinTech guide here: https://chambers.com/department/peter-oakes-consulting-fintech-49:2743:114:1:23173986

Back to Blog

"Perhaps they could be a company that's involved in lending and rather than you having to give your data in a form, you give them permission to scrape the detail from your account and they can say 'yep, we can see that that's your income, it's coming in every month and here's where your outgoings are'," said Peter Oakes, founder of FinTech Ireland.

There are currently just a handful of firms authorised by the Irish Central Bank to provide these kinds of added services, however many others that have approval from other European authorities will also be available here under 'passporting' rules. That means there may be many new functions available to online banking customers in the near future. "There's likely to be quite a demand for these sort of things from consumers," said Peter Oakes, founder of FinTech Ireland." https://www.rte.ie/news/business/2019/0913/1075730-open-banking-psd2/

Back to Blog

September 12, 2018 EU Officials Pitch Expanded AML Oversight Role for European Banking Authority By Koos Couvée

Peter Oakes, former director of enforcement and AML at the Central Bank of Ireland, told ACAMS moneylaundering.com that if the plan takes eect, nancial institutions can expect scrutiny of their AML programs by the European Central Bank and other EU-level authorities. Banks should respond by identifying “gaps in the current management informationreporting mechanism and potential gaps in policies and procedures,” Oakes, now a consultant with CompliReg.com in Dublin, said. “Those will have to be remediated.” Read full article here: https://peteroakes.com/uploads/3/5/4/6/35467825/20180912-acams-koos-couvee-eu-officials-pitch-expanded-aml-oversight-role-european-banking-authority-aml-reforms-peter-oakes-complireg.pdf

Back to Blog

'Oakes, who founded Ireland’s first regulatory technology support group, Fintech Ireland, is surprised by the absence of comment by the Central Bank'

A former Central Bank regulator has warned Irish investors about the risks associated with a wave of unregulated "bitcoin-fuelled investment fund mania". The warning comes after Enterprise Ireland ordered two fintech firms to remove website information and amend details in an investment prospectus that may have led investors to believe Initial Coin Offerings (ICO) valued at €2.5m were endorsed by the State agency. Cryptocurrency firm MingoCoin - which is chaired by former Baltimore Technologies chief Fran Rooney and cites One Direction star Niall Horan as a shareholder and brand ambassador - aimed to raise €2m in a token presale which ended on October 9. The pre-sale raised over €650,000 in the first hour alone. The firm, which has received startup funding from Enterprise Ireland (EI), was contacted last week by EI officials and ordered to amend or remove promotional material linked to the ICO that could be misconstrued as an endorsement by the Stage agency. Mingocoin founder and ceo Joe Arthur confirmed the firm has held talks with Enterprise Ireland about its use of the State agency's name in promotional material. "They have asked us to clarify the position in relation to the ICO," Arthur said. "We have discussed that with them and obviously we have clarified that in our prospectus." A second Irish-based bitcoin startup, Confideal, which has already raised about €550,000 in a pre-sale and is preparing to start an ICO on November 2, was also ordered by Enterprise Ireland to remove website material that suggested the state agency was a 'partner' and had endorsed its initial coin offering. Initial Coin Offerings are typically used by startups to bypass regulated venture capitalists and banks. Enterprise Ireland is exercising caution as ICOs are arousing greater scrutiny from regulators worldwide, it is believed. China and South Korea have banned ICOs and the UK's financial watchdog, the FCA, has cautioned investors and consumers. Peter Oakes, a former director of enforcement at the Central Bank, believes that the lack of disclosure about the risks of investing in ICOs, including the loss of the entire amount invested, is not being explained clearly to Irish investors. With bitcoin popularity taking hold in Ireland, and with investment in ICOs worldwide estimated at €2.4bn, Oakes said: "No wonder firms and investors are jumping on the bandwagon. And no wonder some regulators are finally catching up." Oakes, who founded Ireland's first regulatory technology support group, Fintech Ireland, is surprised by the absence of comment by the Central Bank. "On the one hand, you could take the simplistic view that it is a case of 'caveat emptor'," Oakes, pictured, said. "On the other hand, you could ask if the Central Bank needs to consider doing more under its 'protecting consumers' and investor protection mandates, especially that it wasn't long ago that money managed by supposedly expert and regulated advisors was misappropriated," he said, referring to the collapse of Bloxham Stockbrokers and Custom House Capital. The Central Bank said it is examining the potential risks posed by virtual currencies. ICOs currently fall outside the scope of Irish law. https://peteroakes.com/uploads/3/5/4/6/35467825/20171015-beware-bitcoin-funding-mania-investors-told-peter-oakes-fintech-ireland-independent-online.pdf |

© Peter Oakes (all rights reserved)

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.

There is no consent nor legitimate interest right available to data vendors (e.g Zoominfo.com) and others to use email addresses, phone numbers and address details to send unsolicited marketing communications. This notice prevents you from claiming a business-to-business avenue to send unsolicited communications to any contact details appearing on this website. The email address PETER AT PETEROAKES.COM is a personal email address and is also protected by GDPR rights.

Privacy Statement.